Be Greedy When Others Are Fearful? Options Traders Bet on Chinese Stocks Recovery

By moomoo news Jimmy Wang

International investors have avoided Chinese equities as its annual returns haven't outperformed emerging markets since 2020. Options traders are now placing their bets, seeking strategic opportunities for potential gains should the markets recover.

According to Bloomberg, there has been a surge in the volume of options that target US-listed exchange-traded funds that monitor Chinese markets amidst the volatility caused by remaining pandemic-impact, macro headwinds, and real estate market turbulence.

This investment approach is akin to purchasing inexpensive 'lottery tickets' that could yield substantial returns if the market shifts favorably.

"It's simply buying cheap lottery tickets with a potentially big payout," said Charlie McElligott, managing director at Nomura Securities International. The worse Chinese stocks fare, "the more attractive it becomes from a risk-reward perspective," he said.

The interest in ETF-related derivatives is seen as a sign that some investors are starting to respond to the Chinese government's attempts to halt the market decline.

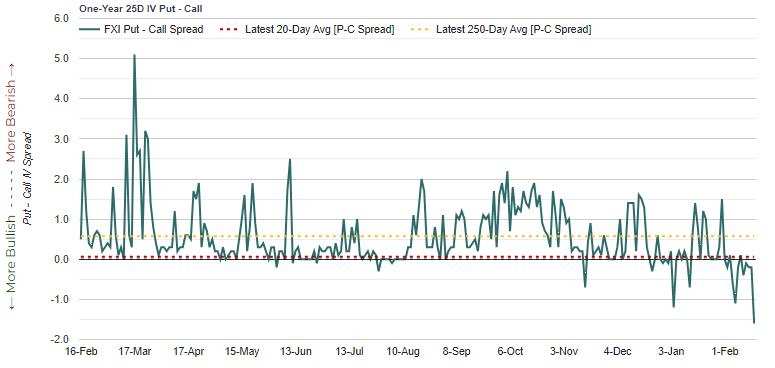

The one-month put-versus-call skewness of the ETF, which tracks the FTSE China 50 Index, has been inverted multiple times in recent weeks and is now dropping to the most negative level that has not been seen in a year.

The implied volatility skew shows the market's bias for pricing in volatility risk to the option premium of downside puts and upside calls. If the implied volatility for downside puts is increasing relative to upside calls, then that suggests the market is pricing in a larger fear of a downside move.

According to Ling Zhou, TD Cowen's head of equities derivatives strategy, this suggests that traders have been using options to profit from market upswings.

Investor interest has been particularly pointed towards short-term derivative contracts to take advantage of Chinese equities' low valuations before critical events take place, like the National People's Congress meeting and the US presidential election.

Source: Bloomberg, Market Chameleon

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Malik ritduan : ok

73164454 : Under the premise of an overall economic downturn, how can stocks rise

Tbeanbean : Does speculation anticipate that stocks will never be good in the future?