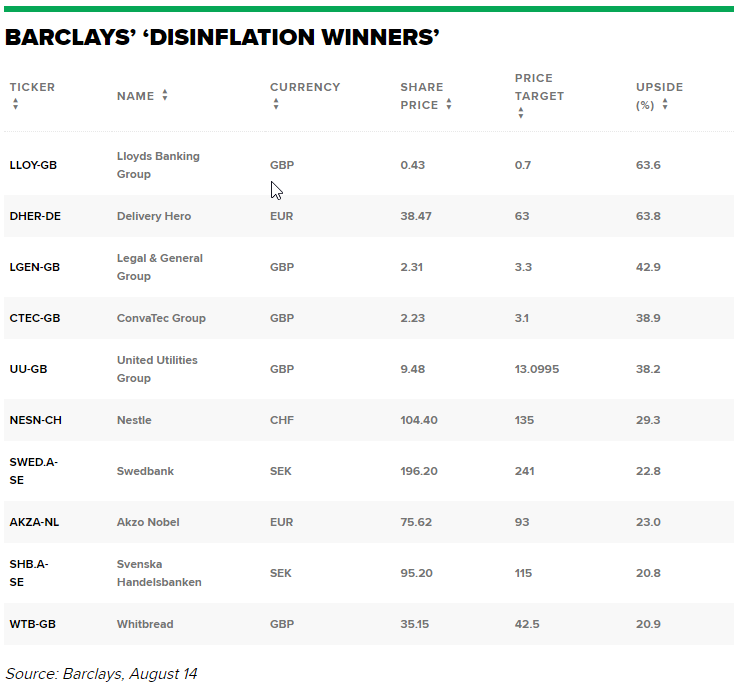

Barclays named stocks that will benifit from deflation, 60% upside

According to CNBC, $Barclays(BCS.US$ identified several European stocks that it says could benefit from an environment of falling inflation.

Disinflation – the slowing down of the inflation rate — is particularly tricky for some companies, as their profits do not grow in line with their cost pressures.

Euro zone inflation fell to 5.3% in July, down from a peak of 10.6% in October 2022. As interest rates remain elevated, inflation is expected to fall further toward the European Central Bank’s 2% target in the coming months.

The investment bank said its stock picks it called“disinflation winners”are particularly adept at operating in the current environment, with at least two picks expected to rise by more than 60% over the next 12 months.

“European equities posted solid returns in July, with sentiment in the economy improving given expectations that inflation is peaking and growing hopes for a soft landing,” said Barclays’ strategists, including Emmanuel Cau, in a research note to clients on August 15.

Delivery Hero

Among the stocks highlighted, Barclays said shares of food delivery company Delivery Hero had the biggest upside potential. Barclays expects the stock to rise by 64% over the next 12 months to 63 euros ($68.9).

“Delivery Hero has the most forward thinking vision of the EU delivery aggregators, in our view. It is a space on which we are positive, and that flows into our assessment of the investment case,” said Barclays analysts.

Lloyds Banking Group

Barclays expects shares of U.K.-based lender Lloyds Banking Group to rise 64% over the next 12 months to £0.70 ($0.89). U.K.-listed shares are typically quoted in pennies instead of pounds.

Legal & General

Barclays analysts are also bullish on the U.K. life insurance sector and expect shares of L&G to rise by 42% over the next 12 months.

What do you think, are you hedging against deflation in the European market, or overall?

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment