Are Fortunes of Small-Cap and Mega-Cap Stocks Poised to Reverse?

$Bank of America(BAC.US$ suggests that the US stock market is likely to experience a shift soon, if history is any guide.

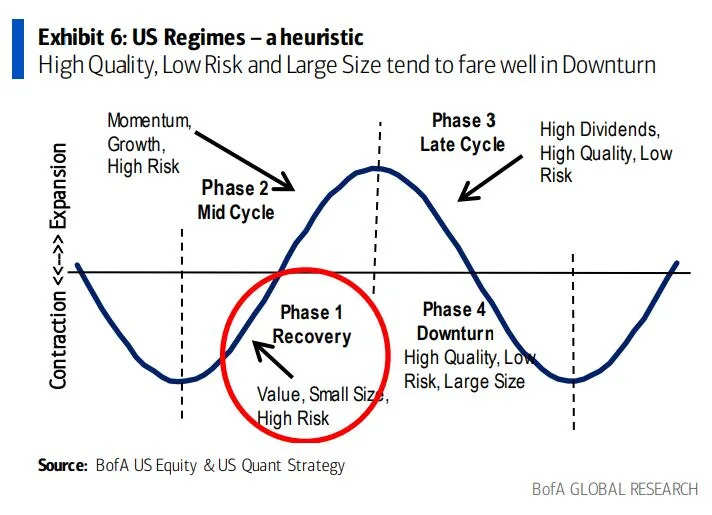

According to strategists led by Savita Subramanian, with equities currently in the recovery phase of the business cycle, this year's underperformers such as value and small-capitalization stocks are likely to outperform. This will disrupt the growth and large-cap leadership that has dominated the bull run of 2023. BofA's quantitative model, the US Regime Indicator, has remained relevant in capturing factor trends, even though the last few years have been unclear from a "cycle" perspective.

But our US Regime Indicator has remained relevant in capturing factor trends," Savita said of the firm's quantitative model, adding that January to June marked a downturn phase where investors flocked to safety in growth and quality names.

Historically, such phases of the cycle have favored financials, industrials, and materials, while utilities, health care and staples have tended to underperform, BofA said.

The rally in US equities this year came to a halt in August as the strength of the economy prevented investor optimism regarding the Federal Reserve nearing an end to its rate-hiking campaign. The $S&P 500 Index(.SPX.US$ has witnessed a decline at the start of September, but it remains up more than 16% year-to-date. More than half of the stocks in the Russell 2000 — a gauge of smaller companies — have dropped this year, holding it to a 6% gain, far below the 16% jump in the S&P 500.

So much of this year's performance has been about AI enthusiasm, which disproportionately benefitted the largest tech stocks," said Steve Sosnick, chief strategist at Interactive Brokers. "It's been a top-down set of winners so far."

The small-caps stocks joined in the equity-market rally from June through July. But they've been hit hardest during the recent pullback, with about $9.7 billion of short-sellers' estimated profits emerging since August, according to S3's data. One reason for the underperformance is sector weightings that have curbed interest as investors focus heavily on particular industries, said Rob Haworth, a senior investment strategist at U.S. Bank Wealth Management. The group has little exposure to technology, the best-performing corner of the market this year, and heavier weightings in finance and energy, some of the worst laggards. Small companies are also the most heavily affected by economic slowdowns and tighter monetary policy.

They also tend to be the companies that take the brunt of tighter credit conditions and tighter lending standards," Haworth said. "I think that's kind of created this environment that's put a lot of pressure on small caps."

However, Bank of America's perspective conflicts with $Morgan Stanley(MS.US$'s viewpoint. The latter's bearish chief US equity strategist, Mike Wilson, suggested that investors should prioritize a "late-cycle portfolio" consisting of defensive stocks like industrials, healthcare, and energy. Although Wilson accurately predicted the stock market rout in 2022, his pessimistic forecast has yet to materialize this year.

The US stock rally this year has been the subject of debate on Wall Street. While some strategists, such as John Stoltzfus from Oppenheimer & Co. and Binky Chadha from Deutsche Bank AG, have considered recent weakness expected, with modest pullbacks being a regular part of market cycles, others, like Mike Wilson, have viewed recent price action as a sign that markets are catching up to poor macroeconomic fundamentals.

Investors' next significant obstacle is the monthly consumer-price index report scheduled for release on Wednesday. The report will provide insight into how much further the Federal Reserve will need to raise interest rates to achieve its inflation targets.

Source: Bloomberg, BofA, Yahoo Finance

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment