Analysts Slash Tesla Delivery Forecasts Amid Diminishing Demand – Are More Losses Ahead?

It was a lackluster quarter for $Tesla(TSLA.US$ investors. As the first-quarter delivery figures approach, investors are anxious as Wall Street has lowered its expectations amid a slowing electric vehicle market with strong price competition. Expectations for the numbers are tempered, yet a glimmer of hope remains.

Prior to the delivery data release and earnings report this month, several Wall Street analysts have lowered their delivery expectations for the company, citing softening demand and intensifying competition, prompting further reductions in their target prices for Tesla's stock.

The consensus call for the first quarter aggregated by FactSet is 457,000 units, up from 423,000 units delivered in the first quarter of 2023. Motor Intelligence data reveals Tesla delivered approximately 108,000 vehicles in the U.S. during January and February, falling short of the 114,000 delivered in the same period last year.

The most recent estimates coming from the Street are in the 425,000 range. Any figure above 420,000 units would be a relief, according to Wedbush analyst Dan Ives, while investors are braced for a figure that would go below 410,000 units.

Regionally, CnEVPost reports a near 5% annual dip in Tesla's Chinese deliveries for the initial 12 weeks of the quarter. Meanwhile, European sales tallied roughly 46,000 units over January and February, a significant 41% year-over-year uptick, albeit trailing the robust growth seen in the closing months of the previous year.

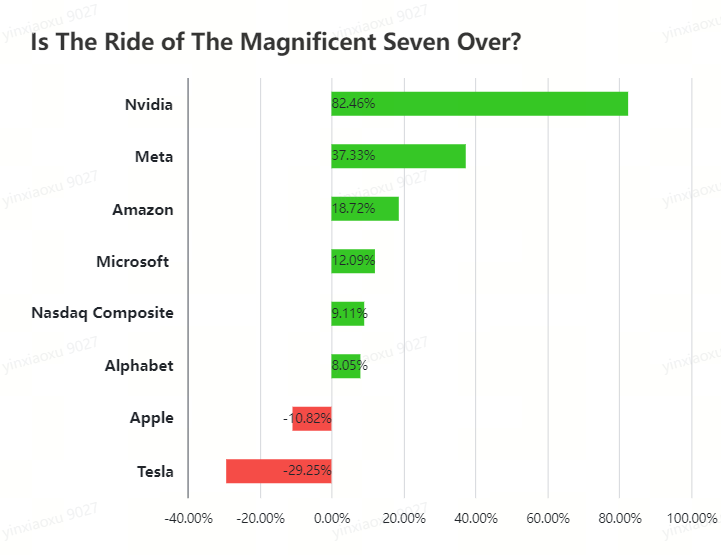

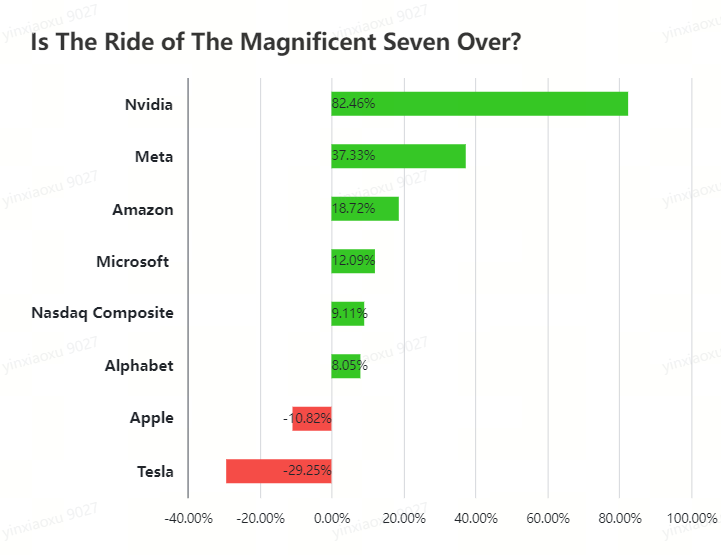

In response to the worsening expectation, Tesla's shares tumbled nearly 13% in March, marking a decline exceeding 29% for the quarter—their third-largest quarterly drop since going public—making it the worst performer in the $S&P 500 Index(.SPX.US$.

Muddy China Market

Tesla is facing heightened competition in China from a slew of affordable fully electric vehicles, challenging its dominance in the market. Chinese automaker $BYD Co.(BYDDF.US$ has overtaken Tesla as the world's leading EV manufacturer, and continued to apply pressure by launching budget-friendly models such as the Qin Plus EV and the BYD Seagull. Additionally, Chinese smartphone maker Xiaomi has entered the electric vehicle segment with its own SUV, priced significantly lower than Tesla's entry-level Model 3, with $Xiaomi Corp. Unsponsored ADR Class B(XIACY.US$'s CEO admitting the company will incur losses at such pricing.

Despite price cuts by Tesla, the company's sales in China have remained sluggish. Official figures from the China Passenger Car Association indicate a drop in sales of China-made Tesla cars in the early months of the year, with a significant reduction in domestic sales and exports. In response to the declining demand, Tesla scaled back production at its Shanghai factory, reducing the workweek for its staff.

Analysts predict a challenging year ahead for Tesla, particularly due to its performance in China. Deutsche Bank's Emmanuel Rosner, noting the weaker-than-expected sales in China and Tesla's recent production cutback, has adjusted his price target for the company and anticipates Tesla will report lower delivery figures for the first quarter. Furthermore, Rosner anticipates only a modest, mid-single-digit growth for Tesla over the year.

"Tesla may be witnessing price-cut fatigue with consumers and may be testing profitability levels that the company may not find acceptable," Morgan Stanley analyst Adam Jonas said in a report to clients earlier this month, "such conditions may not significantly improve near-term given the age of Tesla's product line-up."

Hope Remains

However, Tesla may still be set for a better first quarter than some analysts expect.

Tesla announced via Twitter last Friday afternoon that it had manufactured its sixth millionth car. Based on Tesla's typical quarterly production and sales reports, it is estimated that the electric vehicle titan produced around 440,000 vehicles by March 29. Factoring in production on March 30 and 31, Tesla's first-quarter production might reach 450,000 units, as posited by Barron's Al Root.

However, production numbers do not equate to sales, with recent quarters showing an average discrepancy of about 15,000 units. A cautious yet reasonable estimate for Q1 deliveries, inferred from Tesla's tweet, would be in the range of 425,000 to 435,000 vehicles. The exact figures remain uncertain, as inventory levels could have increased or decreased, but the recent tweet provides investors with an alternative perspective as they await the official quarterly data due on April 2.

FSD Installation and Demo

Altimeter Capital's Brad Gerstner is buying the dip. Gerstner told CNBC last week that the company is now making "massive progress at an accelerating rate" on its self-driving technology efforts.

For several years, Musk has made bold predictions regarding Tesla's technological advancements. In 2015, he informed shareholders that by 2018, Tesla vehicles would reach "full autonomy," capable of self-driving. The following year, Musk claimed that by the end of 2017, Tesla would be able to complete a cross-country trip entirely autonomously, without any human input. Last week, Elon Musk mandated Tesla employees to install and demo Full Self-Driving Beta for every customer taking delivery in North America.

Source: Barron's, CNBC

by Moomoo New's Jimmy Wang

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment