AMD's Q3 2023 Earnings Preview: Here Are the Key Factors to Watch

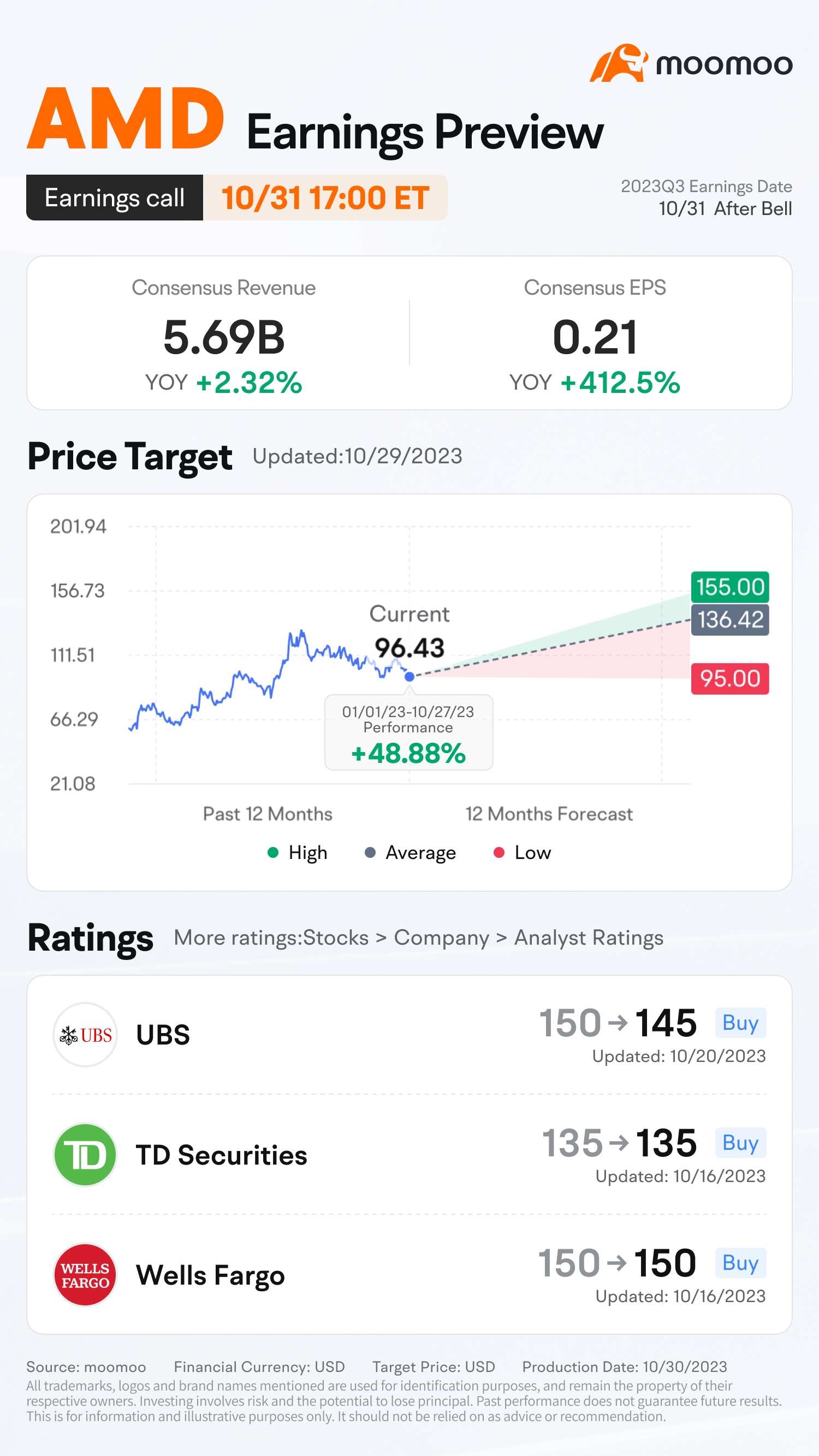

With 30 analysts currently covering the stock, Advanced Micro Devices (AMD) has received consensus ratings of 'hold' and 'buy.' The target price range for AMD's stock is between $95 and $150. Based on the previous close of $96.43, it suggests that there may be an opportunity for potential upside in the stock.

We expect AMD to report in line but likely guide Q4 in line to modestly below consensus as it faces headwinds in its embedded (Xilinx) and console (seasonal, product maturity) sales," the analysts wrote. "However, all eyes will likely be on clues to MI300 AI accelerator ramp for [2024]." according to Bank of America analyst.

The analyst noted that AMD operates in the appealing "compute" sector, but maintain a neutral rating on the stock. This is due to the fact that AMD is currently trading at 25 times the estimated earnings for 2024.

AMD's Revenues are expected to be $5.69 billion in Q3 2023, indicating growth of 2.32% year over year.

The consensus estimate for third-quarter EPS is pegged at 21 cents per share. The figure indicates growth of 412.5% on a year-over-year basis.

Here are the key factors to watch:

Strong Performance in PC

AMD's revenue growth in the third quarter is predicted to have been boosted by a recovering PC market, especially on the consumer side. According to Gartner's recent report, global PC shipments reached 64.3 million units in Q3 of 2023, marking a year-over-year decline of 9%. Despite slow enterprise sales, there was strong demand for PCs in the education sector, which helped drive overall demand.

Weak Performance in Embedded and Gaming

In the second half of 2023, AMD's embedded revenue is expected to decline due to indications of normalizing backlogged order fulfillment, decreased customer inventory, and persistent weakness in telecom spending. Additionally, gaming revenue for AMD is anticipated to lessen as Xbox and PS5 game console cycles mature.

Key Product Developments of Data Center

1. Zen4 EPYC Server CPUs

AMD has recently unveiled the 8004 series processors, which are built on Zen 4c core and feature a new SP6 socket, thus expanding its fourth-generation EPYC CPU portfolio. In comparison to its closest competitor, the EPYC 8004 series processors can deliver up to twice the SPEC power performance per system watt. These processors also provide balanced performance along with exceptional energy efficiency.

2. MI300 Product

AMD's official launch of the MI300 is expected to attract significant investor attention and serve as a driving force for the company. The MI300 is anticipated to be deployed in El Capitan in Q4 2023, generating revenue that exceeds $300 million. Moreover, AMD is expected to announce progress on customer conversions from the MI300X (GPU only) into commitments, which will have implications for 2024.

Source: Yahoo Finance, Seeking Alpha, The Fly, Company Website

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Randy James Lowery : Thank you so much and I would like to ENROLL ALL MY EARNINGS INTO MY CHIME CHECKING ACCOUNT PLEASE![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)