AMD's 43% Rally This Year Spurs Options Block Trades Worth Millions of Dollars

The AI-fueled rally that sent $Advanced Micro Devices(AMD.US$ shares skyrocketing over 43% this year is fueling millions of dollars in block trades of options that could provide a cushion in case of a price correction, while giving the holder the chance to benefit should the record-breaking ascent continue.

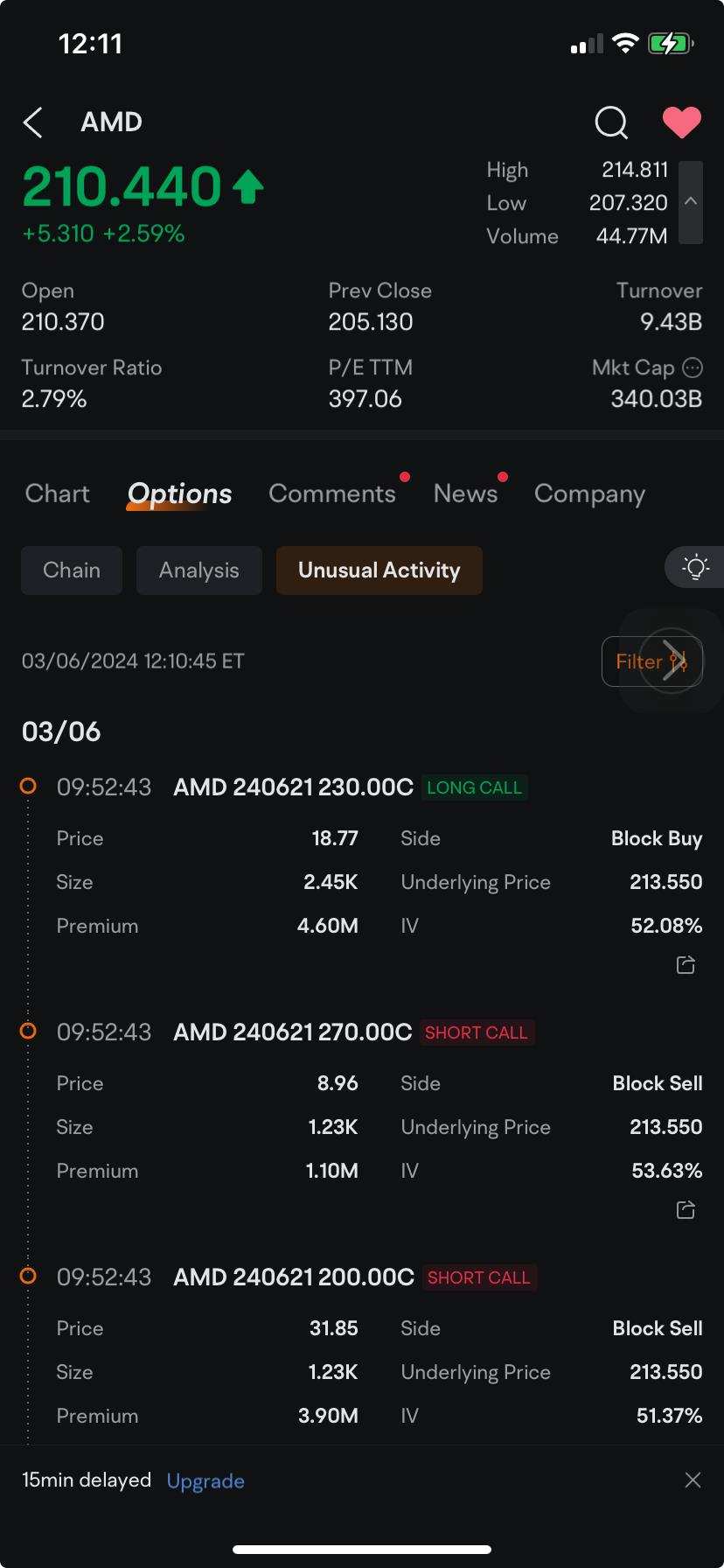

At 9:52:43 a.m. New York time, three block trades of call options were posted, signaling the transactions were made under one strategy. One of them is for long calls with an active buyer paying a $4.6 million premium for options giving the holder the right to buy about 245,000 shares at $230 each by June 21, according to data tracked by moomoo.

At 9:52:43 a.m. New York time, three block trades of call options were posted, signaling the transactions were made under one strategy. One of them is for long calls with an active buyer paying a $4.6 million premium for options giving the holder the right to buy about 245,000 shares at $230 each by June 21, according to data tracked by moomoo.

That implies further upside for the stock that's already climbed more than 150% in the past 12 months. On Wednesday, the shares rose 2.8% to $210.96. The rally came as AMD competes with market leader $NVIDIA(NVDA.US$ in manufacturing powerful semiconductors designed for artificial intelligence applications.

Another block trade was posted involving short calls where the active seller stands to get a $3.9 million premium for writing call options that give the holder the right to buy 123,000 AMD shares at $200 a share with the same expiration date. Those options, which were sold at $31.85, traded at $28.875 as of 11:51 a.m. in New York, signaling the seller could post a profit should he or she decide to buy it back at that level.

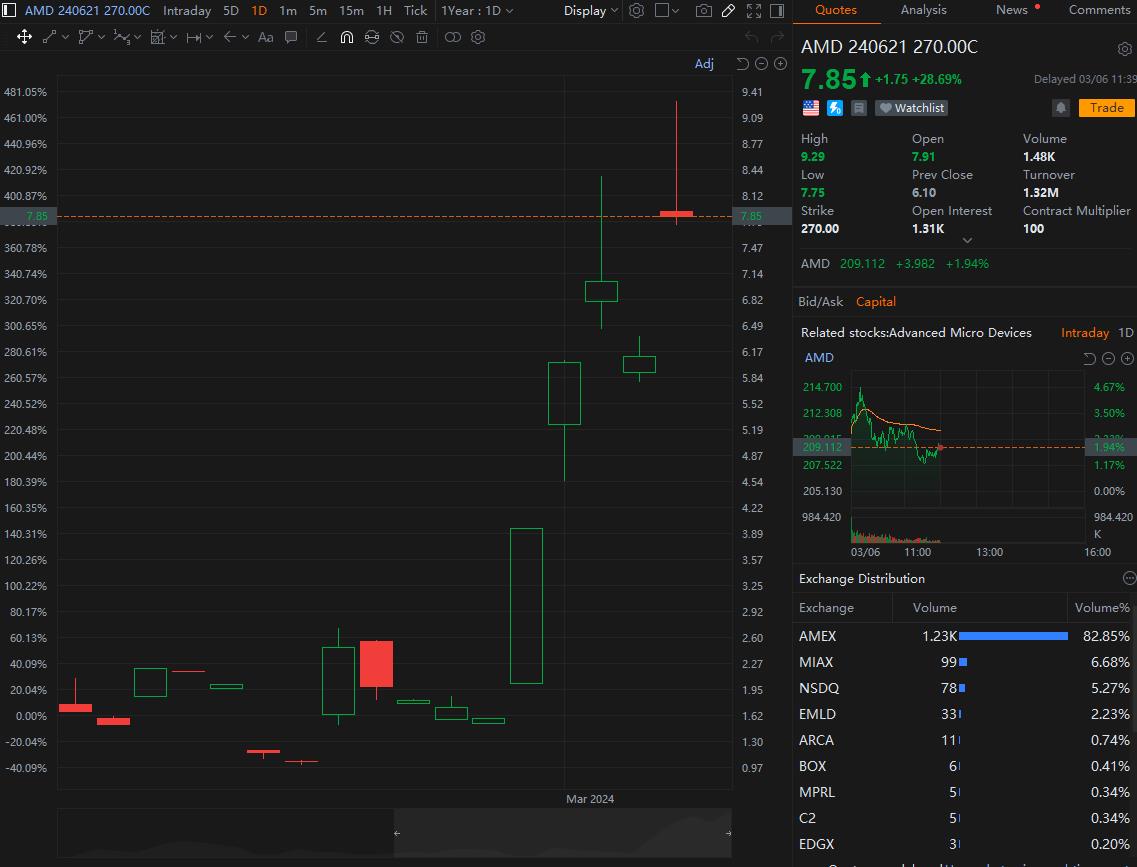

The third block trade with the same expiration date was for short calls with an active seller that could collect a $1.1 million premium for writing call options that give the holder the right to buy 123,000 shares at $270 each.

Those call options, which were sold at $8.96 a share, could remain out-of-the-money until the price of the underlying stock trades above the $270 strike price. As of 11:52 a.m., the contract traded at $7.85, implying that the seller could buy it back at a profit, should the transaction be done at that level.

On Tuesday, AMD Chief Financial Officer Jean Hu said the company expects a "much better backdrop" for the server market as she sees customers boosting their investments in servers this year, after shifting spending to artificial intelligence in 2023.

The company's data center segment revenue, which includes server microprocessors, graphics processing units and accelerated processing units, rose 7% in 2023, according to its financial results posted on its website Jan. 30.

The block trades come at a time when sentiment has turned sour on the stock that has skyrocketed this year. Ten of the 15 technical indicators tracked by moomoo are showing bearish signals, with the stock's relative strength index flagging severely overbought conditions.

Still, analysts remain optimistic on the company's outlook. More than 85% of the 37 analysts tracked by moomoo have a buy rating on the stock, and zero sell.

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

102514703 : 213 will be very dangerous. It's impossible for it to rise a lot with such bad news. I hope I think more

70183665 : Put on your shoes - walk

- walk

macfan28 : Now this is really the kind of posts we should have here. Informational and beneficial.