After Reaching Near Two Year High, Malaysia's Plantation Stocks Experience Pullback: What Lies Ahead?

At the beginning of February, the Malaysian plantation sector reached a new high not seen since June 2022, The $Bursa Plantation(0025I.MY$, tracking 40 stocks within the sector, soared to a 20-month high with an impressive gain of nearly 5% earlier this year, reflecting investors' renewed confidence in the sector.

Plantation Sector Catalyst:

This uptick comes amidst relative stability in Malaysian crude palm oil (CPO) prices, even as other related commodities like U.S. crude oil and soybean oil showed signs of weakness. The steady CPO prices have indirectly bolstered the profitability of plantation companies.

In addition, potential catalysts for the sector include the likelihood of Malaysia's palm oil stocks dropping to the critical demand level of 2 million tonnes in the forthcoming three months due to lower production, which could further support or propel palm oil prices.

Moreover, Malaysia's strategic move to double palm oil exports to China to half a million tonnes annually signals a proactive response to European restrictions, potentially opening up new avenues for growth in one of Malaysia's key export countries.

Top Traded Plantation Stocks:

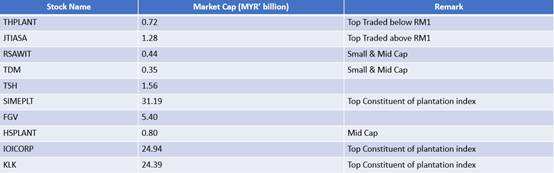

Among the top traded plantation stocks were THPLANT, JTIASA, RSAWIT, TDM, TSH, SIMEPLT, FGV, HSPLANT, IOICORP, and KLK, as reported by Bursa Malaysia.

Industry Challenges: Some Companies' Earnings Fall Short of Expectations:

However, the sector wasn't without its challenges. Some plantation stocks retreated due to weaker-than-expected earnings, which sparked concerns about the sustainability of the recent share price growth.

$SIMEPLT(5285.MY$, the world's largest palm oil producer by acreage, saw its stock slip 1.56% to RM4.43 after reporting a substantial net profit decline of more than 64% to RM200 million for Q4FY2023.

$KLK(2445.MY$ also experienced a significant earnings drop, with net profit falling 49% year-on-year to RM226.94 million in Q1FY2024, while its stock price decreased by 2.18% to RM22.36.

$TAANN(5012.MY$'s stock declined nearly 4% to RM3.65, following the trend of lower-than-expected quarterly earnings.

Plantation Sector Outlook Amid CPO Price Fluctuations:

Some Analysts have indicated that the current weakness in some plantation stocks may be due to profit-taking after a rally in CPO futures. Kenneth Leong, head of research at Apex Securities, expects subdued growth in earnings with CPO prices hovering between RM3,800 and RM4,000 per tonne.

Despite the mixed performance, Sime Darby Plantation and KLK are anticipating palm oil prices to maintain their current levels throughout the year. With the benchmark three-month palm oil futures trading at RM3,822 per tonne on Bursa Malaysia Derivatives and analysts maintaining hold calls on stocks like Sime Darby Plantation, the plantation sector continues to be a focal point for investors seeking opportunities in a market that is both dynamic and influenced by a variety of global factors.

Source: The Edge Malaysia, Bloomberg, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103412459 : Good