After Lowering Down Payment Requirements, More China's Housing Easing Policies Are Underway

Last week, four Tier-1 cities in China announced they will treat qualified families previously classified as second-home buyers as first-time buyers for mortgage borrowing, effectively reducing their down payment requirements and mortgage rates. This new easing measure, if broadly implemented in large cities, may provide a modest growth impulse to the property market in large cities.

Recent institutional reports suggest a combination of monetary, fiscal and housing easing measures is still possible in the coming months, if the increase in real estate sales following last week's policy announcement is temporary. The magnitude and style of such easing are likely to remain piecemeal. These measures include:

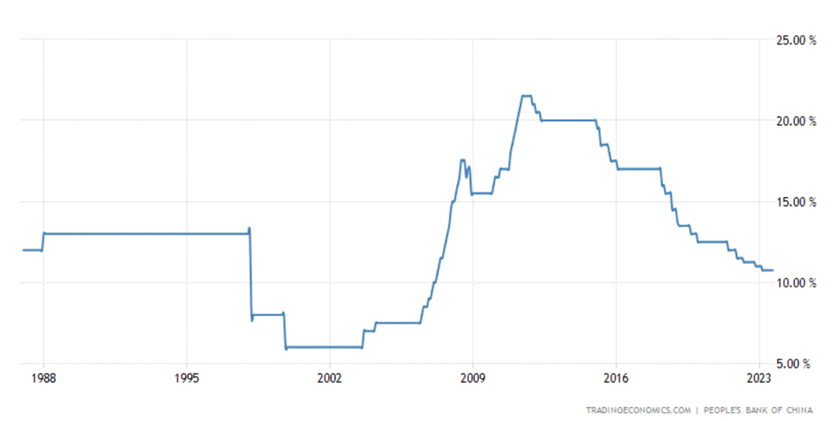

■ Reserve Requirement Ratio (RRR) Cut

The analyst Lisheng Wang of Goldman Sachs expected a 25bp RRR cut in September and another one in Q4. The People's Bank of China (PBOC) already reduced the reserve requirement ratio for almost all banks by 0.25 percentage points in March. The cut is normally aimed at ensuring liquidity in the banking system to boost the pace of lending.

■ Rate Cut

Goldman Sachs expected a 10bp OMO rate cut in Q4. The Open Market Operation is a transaction for the People's Bank of China to purchase securities, release money, and agree to sell securities on a specific date in the future. Changes in OMO interest rates are regarded as pre-signals for adjusting MLF and LPR interest rates.

■ Other Monetary Tools:

PBOC may also inject more long-term liquidity to the banking system through MLF, relending and PSL if needed.

The PBOC created PSL in 2014 to provide cash for policy banks to finance the shantytown renovation program, which helped turn around a property market downturn back then but was heavily criticized later for inflating the real estate bubble in lower-tier cities. The government relaunched the tool in October 2022 but halted earlier this year. Since the government is seeking every possible way to expand the funding source for policy banks, the reuse of PSL is likely If real estate sales still don't pick up.

■ Local Government Special Bond

Local government special bonds are mainly used to provide financing for infrastructure investment. China briefly reduced the issuance of LGSB in the first half of the year and held off on introducing fiscal stimulus measures earlier. But with Beijing setting a September deadline for the regions to issue their remaining allocation for the year, analysts are expecting a boost to debt supply next month.

That, in turn, would result in a possible liquidity squeeze and prompt the need for more monetary policy easing steps.

Goldman Sachs expected an additional RMB500bn LGSB quota beyond this year's budget (from previous year's unused quota) to be approved for infrastructure investment.

Policymakers may also increase policy bank credit support to boost fiscal spending and help local governments with their debt refinancing.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : good info here