Advice from the world's top investors: invest rather than speculate; be patient for the long term rather than act in the short term; investing far outweighs speculation in terms of wealth accumulation benefits.

Eager to make quick money and big money? When did we become so greedy and anxious? If you want to go fast, you won't get there!

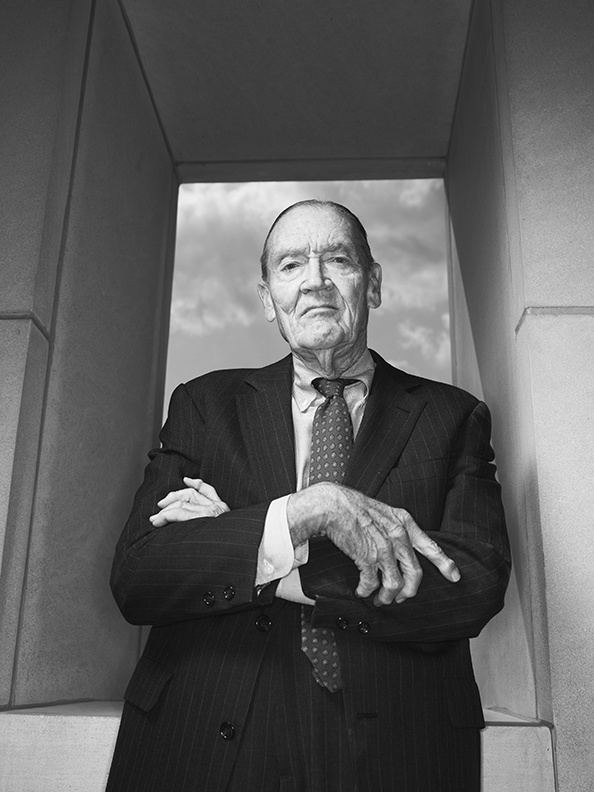

John Clifton “Jack” Bogle (May 8, 1929 — January 16, 2019) was an American investor, business magnate, and philanthropist. He was the founder and chief executive of The Vanguard Group and is credited with popularizing the index fund. An Avid Investor and Money Manager Himself, He Preached Investment Overspeculation, Long-Term Patience Over Commitment Action, and Affordable Broker Fees as Much as Possible. An ideal investment vehicle for Bogle was a competitive index fund investing the entire US market, held over a lifetime with dividends repaid.

“John Clifton “" Jack "” Borg (May 8, 1929 — January 16, 2019) was an American investor, business magnate, and philanthropist.” He is the founder and CEO of Pioneer Group and has been praised for promoting index funds. An avid investor and fund manager, he advocates investing over speculation, long-term patience rather than short-term action, and keeping brokerage fees as low as possible. Borg's ideal investment instrument is a low-cost index fund representing the entire US market, holding it for life and reinvesting dividends.

John Bogle (John Bogle) was born on May 8, 1929 in Montclair, New Jersey, to William Yates Bogle Jr. (William Yates Bogle, Jr.) Her mother is Josephine Lorraine Hipkins (Josephine Lorraine Hipkins).

His family was hurt by the Great Depression. They lost their money and had to sell their house. His father abused alcohol, which led to his parents' divorce.

Bogle and his twin David attended Manas Kwan High School near the New Jersey coast for a period of time. Their academic results there enabled them to transfer to Blair College on a work scholarship. At Blair, Bogle showed a special talent for mathematics, and he was fascinated by numbers and calculations. In 1947, Bogle graduated with honors from Blair College and was accepted to Princeton University, where he studied economics and investing. Bogle studied the mutual fund industry while in college. During his junior year and senior year, he dedicated his thesis “The Economic Role of Investment Companies”.

Bogle graduated with honors from Princeton University in 1951 and was soon hired by Walter L. Morgan (Walter L. Morgan), founder of the Wellington Foundation, supposedly because Morgan read his 130-page paper.

After graduating from Princeton University, Bogle sought positions in banking or investment. In 1955, Bogle was hired by Morgan of the Wellington Foundation and promoted to Assistant Manager, where he was able to analyze the company and its investment department. Bogle convinced Wellington to change its strategy of focusing on a single fund and create a new fund. In the end, he succeeded, and the new fund became a turning point in his career. Following a successful promotion, Bogle replaced Morgan as chairman of the Wellington Mutual Fund in 1970, but was later fired due to an “extremely unwise” merger he approved. It was a bad decision, which he later considered the biggest mistake of his career. He said, “The great thing about this mistake is that I learned a lot. It's shameful, unforgivable, and reflects immaturity and confidence beyond what is proven.” Part of the reason he formed the index fund was the result of the merger, and the merger terms prohibited him from directly managing funds on behalf of clients. Following the index created by Standard & Poor's, it is possible to create a fund that is not regulated by Bogle himself.

In 1974, Bogle founded Pioneer Group, which is now one of the most respected and successful companies in the investment world.

In 1999, “Fortune” magazine named Bogle “one of the four major investment giants of the 20th century.”

In 1976, influenced by Paul Samuelson's works, Bogle founded the First Index Investment Trust (the predecessor of the Pioneer 500 Index Fund) as one of the first index mutual funds open to the public. It wasn't immediately popular with individuals or the investment industry, but is now being praised by investment legend Warren Buffett and others.

In a 2005 speech, Samuelson “juxtaposed Bogle's invention with the invention of the wheel, the alphabet, and Gutenberg printing.”

In 1984, Bogle met with Primecap's management team to jointly launch a fund. In November 1984, the Vanguard Primecap Foundation was established. Bogle suffered from a heart attack in the 1990s and then stepped down as CEO of Pioneer Group in 1996. His successor was John J. Brennan (John J. Brennan), Bogle's handpicked heir and second-in-command, who was also hired by Bogle in 1982. Bogle was 66 years old at the time, “thought to have passed the age for a healthy heart transplant,” and successfully performed a heart transplant in 1996.

He then returned to Pioneer Group with the title of senior chairman, leading to a clash between Bogle and Brennan. Bogle left the company in 1999 and moved to the Bogle Financial Markets Research Center, a small research institution not directly linked to Pioneer Group, but located on the Pioneer Group campus.

The idea of passive investing in funds that reflect the entire stock market began in the 1960s, mainly proposed by researchers at the University of Chicago who found it difficult or impossible to consistently select winning stocks with better-than-average performance. These researchers also believe that transaction and management costs are a significant drain on long-term return on investment.

The first publicly accessible index fund was founded by Rex Sinquefield in 1973, who later worked for Dimensional Fund Advisors. A few years later, the fund has managed billions of dollars, which shows that the public is open to new investment ideas.

Bogle's early investment career was dedicated to active management, although he was always aware of the importance of low fees and the cost of his funds was much lower than that of his competitors. As academic research favorable to indexation continued to accumulate, Bogle helped popularize these ideas and founded the S&P 500 Index Fund in 1975. He believes that in the long run, index funds will mimic index performance, thereby obtaining higher returns at a lower cost than ordinary index funds. Costs associated with actively managing funds.

Bogle's philosophy of investing in indices provides a clear and notable difference between investing and speculation. The main differences between investment and speculation are time frames and capital risk. Investments focus on obtaining long-term returns while reducing the risk of capital being destroyed, while speculation focuses on short-term returns, with potentially damaging risks to capital. Speculators usually only care about the price of the securities and not the underlying business as a whole, while investors are concerned about the price of the underlying business rather than the securities. Even when a company's cash flow is stable, the market price of securities is far from stable; this is the result of speculators driving up or lowering prices based on hope, fear, and greed. Bogle believes this is an important analysis to consider because short-term venture capital has already flooded the financial market.

Bogle is famous for insisting on the superiority of index funds over traditional active management mutual funds in numerous media appearances and writings. He believes that after considering the fees charged for active management of funds, it is foolish to try to choose actively managed mutual funds and expect their performance to beat low-cost index funds for a long period of time. He is also keenly aware of the importance of overall market valuations and has developed a simple yet reliable method to forecast long-term returns for up to ten years. Bogle added the existing dividend yield to the expected earnings growth, then adjusted it based on the overall market valuation measured by price-earnings ratio and corrected for inflation. He believes that most investors should have at least 20% of the bond allocation to reduce volatility, and when stocks are overvalued and age, they should tend to increase the bond allocation, but they should maintain at least 20% of the stock allocation. During the internet bubble in the late 1990s, Bogle sold most of his shares and correctly predicted poor stock returns and excellent bond performance over the next ten years.

Bogle advocates a simple and common sense approach to investing. Here are his eight basic rules for investors:

Choosing a Low-Cost Fund

Carefully consider the additional costs of consulting

Don't overestimate past fund performance

Use past performance to determine consistency and risk

Beware of stars (such as star mutual fund managers)

Keep an eye on asset size

Don't have too many funds

Buy and hold your fund portfolio

His investment philosophy is the founding principle of the “Bogleheads” forum of the same name. The group is now supported by the John C. Bogle Center for Financial Literacy and hosts national conferences in addition to online forums. Members of the group collaborated on three books that expanded Bogle's investment philosophy.

In his later years, Bogle expressed concern that the growing popularity of passive indices would cause corporate voting power to be concentrated in the hands of the leaders of the three major investment companies (Pioneer Group, BlackRock Group, and State Street Bank), adding that “I did” and did not believe this concentration would be in the national interest.”

Bogle attended his wife's Presbyterian church but remained in the Anglican faith.

Bogle had his first heart attack at age 31, and at age 38, he was diagnosed with a rare heart disease — arrhythmic right ventricular dysplasia. In 1996, at age 66, he underwent a heart transplant.

Bogle had his first heart attack at age 31, and at age 38, he was diagnosed with a rare heart disease — arrhythmic right ventricular dysplasia. In 1996, at age 66, he underwent a heart transplant.

Bogle received an honorary doctorate from Princeton University in 2005 and an honorary doctorate from Villanova University in 2011. Bogle was a board member of the National Constitution Center in Philadelphia, a museum dedicated to the U.S. Constitution. He was Chairman of the Board from 1999 to 2007.

Politically, Bogle is a Republican (calling himself a Teddy Roosevelt Republican), although he voted for Bill Clinton, Barack Obama in 2008 and 2012, and Hillary Clinton in 2016. He supports the Volcker rule and imposing stricter rules on money market funds, and criticizes his opinion that the US government lacks regulation of the financial sector. Bogle said that the current US system is “out of balance” and advocates “using taxes to prevent short-term speculation, limit leverage, increase the transparency of financial derivatives, impose harsher penalties on financial crimes, and establish uniform trust standards for all.” money manager”.

In 2017, Bogle said he believed President Donald Trump's policies would benefit the market in the short term, but dangerous for society as a whole in the long run.

Bogle died at his home in Bryn Mawr, Pennsylvania on January 16, 2019. After Bogle's death, Warren Buffett credited Bogle's contribution to helping individual investors move in a better “direction” in the field of investment. In an interview with CNBC, Buffett said, “Jack has contributed more to investors across America than anyone I know.” Bogle also previously mentioned his contribution to developing the investment pattern in Berkshire Hathaway's 2016 annual shareholder letter.

During the Pioneer Group's high-income years, he regularly donated half of his salary to charities, including Blair College and Princeton University.

In 2016, Bogle's son John C. Bogle Jr., established the Bogle Scholarship at Princeton University. The scholarships fund 20 first-year students in each class.

In 1991, he founded the Armstrong Foundation “to give back to the school that provided him with scholarships in his early years, the hospital that healed his heart, his church, and the United Way.”

In 1999, he was named one of the four “20th Century Giants” in the investment industry by “Fortune” magazine.

Awarded the Woodrow Wilson Award (1999) by Princeton University for “Outstanding Achievement in Service to the Nation.”

In 2004, he was named one of the “100 Most Powerful and Influential People in the World” by Time magazine.

Institutional Investor Lifetime Achievement Award (2004).

Elected a member of the American Philosophical Society (2004).

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment