21 May Trade Mostly Range-Bound. Potential in NVDA, TSLA and GOOGL

Tuesday (21 May)’s trade saw lackluster price action through most of the session. The major indices were trading either slightly above or slightly below prior closing levels. Index levels improved over the last hour of trading, leaving the major indices at session highs.

Some Mega Cap Gains Support Momentum Picked Up

Gains in some mega cap names acted as support for the entire session, picking up momentum in front of the close. The Vanguard Mega Cap Growth ETF (MGK) was down as much as 0.3% earlier, but closed with a 0.4% gain near its high of the day.

NVIDIA was a winner from the mega cap space after exhibiting volatile price action in front of its earnings report after Wednesday's close. NVDA shares had been up as much as 0.7% today and traded down as much as 1.7%, contributing to the overall mixed feeling in the market.

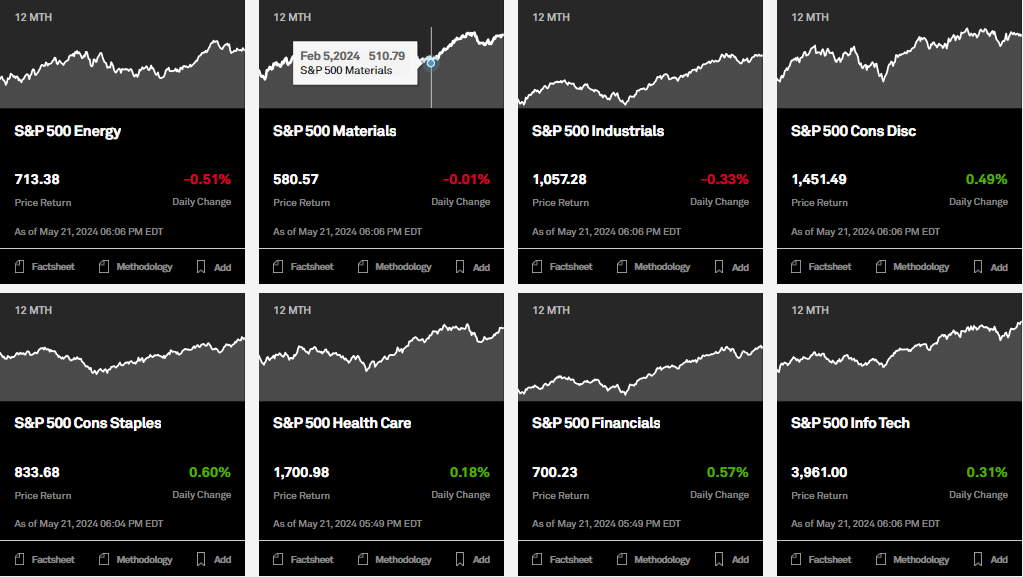

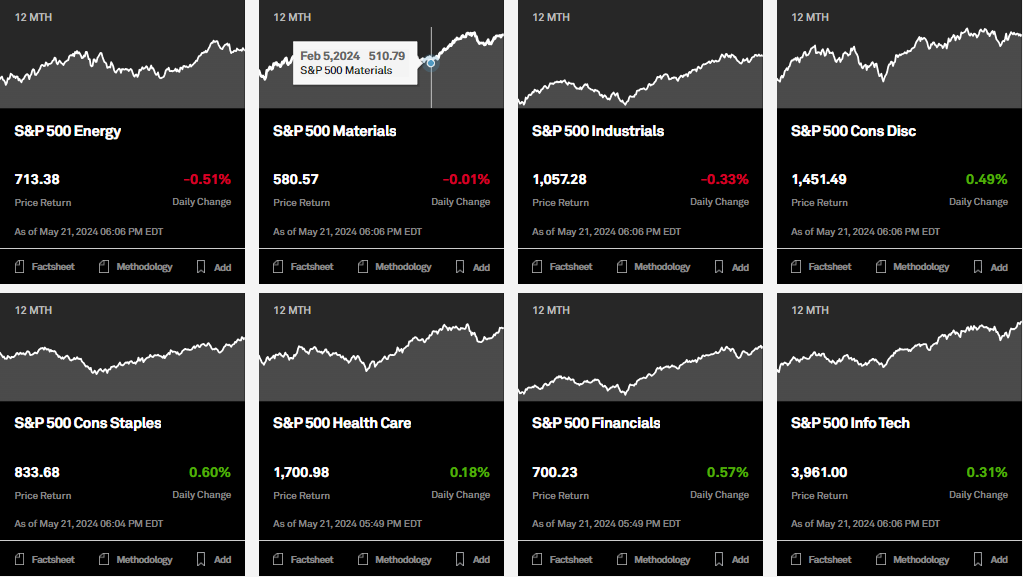

We saw S&P 500 Consumer Discretionary, information technology and financials sectors with positive gains.

Tesla Help Consumer Discretionary Despite Negative Response from PANW

Some high-profile stocks that reported earnings since yesterday's close received negative responses to their results:

Palo Alto Networks (PANW) declined by -3.7%, Lowe's (LOW) declined by -1.9% and AutoZone (AZO) declined by -3.5%. These negative responses acted as a limiting factor for the S&P 500 consumer discretionary sector, along with a 0.2% loss in Amazon.com (AMZN). However, the sector still logged a gain thanks to a jump in shares of Tesla (TSLA) with +6.7%.

Treasury Yields Slightly Lower

Treasury yields settled slightly lower, but that did not translate into support for stocks. The 2-yr note yield settled one basis point lower at 4.83%, and the 10-yr note yield fell two basis points to 4.41%.

Economic Data To Watch On Wednesday

Wednesday's calendar features the release of the Minutes from the April 30-May 1 FOMC meeting and the Existing Home Sales report for April. Wednesday's lineup also includes the weekly MBA Mortgage Index and the weekly EIA Crude Oil Inventories.

Stocks To Watch

$Tesla(TSLA.US$ saw a surge in its stock price on Thursday following its participation at the Advanced Clean Technology Expo in Las Vegas. The company showcased demo rides in its Tesla Semi and announced plans for a new Semi factory in Nevada, expected to be operational by 2026 with a target capacity of 50,000 units annually. During the presentation, exec Dan Priestley emphasized the challenges and significance of electric heavy trucking, highlighting the company's commitment to this sector.

$NVIDIA(NVDA.US$ shares reached a record high on Tuesday, ahead of its earnings report, despite Amazon Web Services halting purchases of Nvidia's Hopper GPUs in favor of the upcoming Blackwell GPU launch. Analysts expect Nvidia to report fiscal first-quarter results significantly above expectations, with an anticipated earnings per share of $5.58 on $24.59B in revenue. KeyBanc Capital Markets noted that Nvidia's current offerings have not been significantly impacted by the pending Blackwell GPU launch.

$Alphabet-A(GOOGL.US$ continued its upward trajectory, closing 1.1% higher on Tuesday, marking seven consecutive sessions of gains. The stock has risen more than 26% year-to-date, outperforming the broader market. Alphabet's strong performance is supported by a Strong Buy rating from analysts, with high marks for profitability despite a lower valuation score.

There is a nice dip on 13 May 2024, which created a buying opportunity for Alphabet, but if we were to follow the MACD, that might not be a good time to buy. Even so, there is a MACD crossover detected on 16 May 2024, these are 2 opportunity that has provided the buying.

Currently, I would say Alphabet is moving in a nice upward trajectory and we might see some selling soon, but do watch out for the next BUY signal, as we can see what happen before 13 May 2024.

Summary

The overall market yesterday (21 May) does not provide much direction and I would say it is trading range-bound, what would be interesting today (22 May) is the semiconductor sectors.

Nvidia upcoming earnings could help to boost this sector and help NASDAQ and S&P 500 to another new highs, but I always believe that we need to follow the price action and watch closely how the whole market moves.

Appreciate if you could share your thoughts in the comment section whether you think NASDAQ and S&P 500 could see new highs from Nvidia earnings and mega caps stellar performance?

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment