2023 Big Trades: From AI Boom to Bitcoin's Comeback, Which Trade Influences Your Portfolio the Most?

In 2023, the global economic and financial situation was complex and changeable. Unexpected regional banking crises and geopolitical conflicts arose, while disruption from the highest interest rates in two decades and concerns about an economic downturn persisted.

Despite the challenges, the excitement surrounding artificial intelligence has driven U.S. stocks to break through the haze. Additionally, U.S. Treasuries have recently resumed their upward trajectory following ten consecutive months of decline, while Bitcoin has staged a strong comeback and the price of gold has skyrocketed, setting numerous historic records.

Below are the significant events closely related to your trading in 2023. Which ones have left the biggest impression on you?

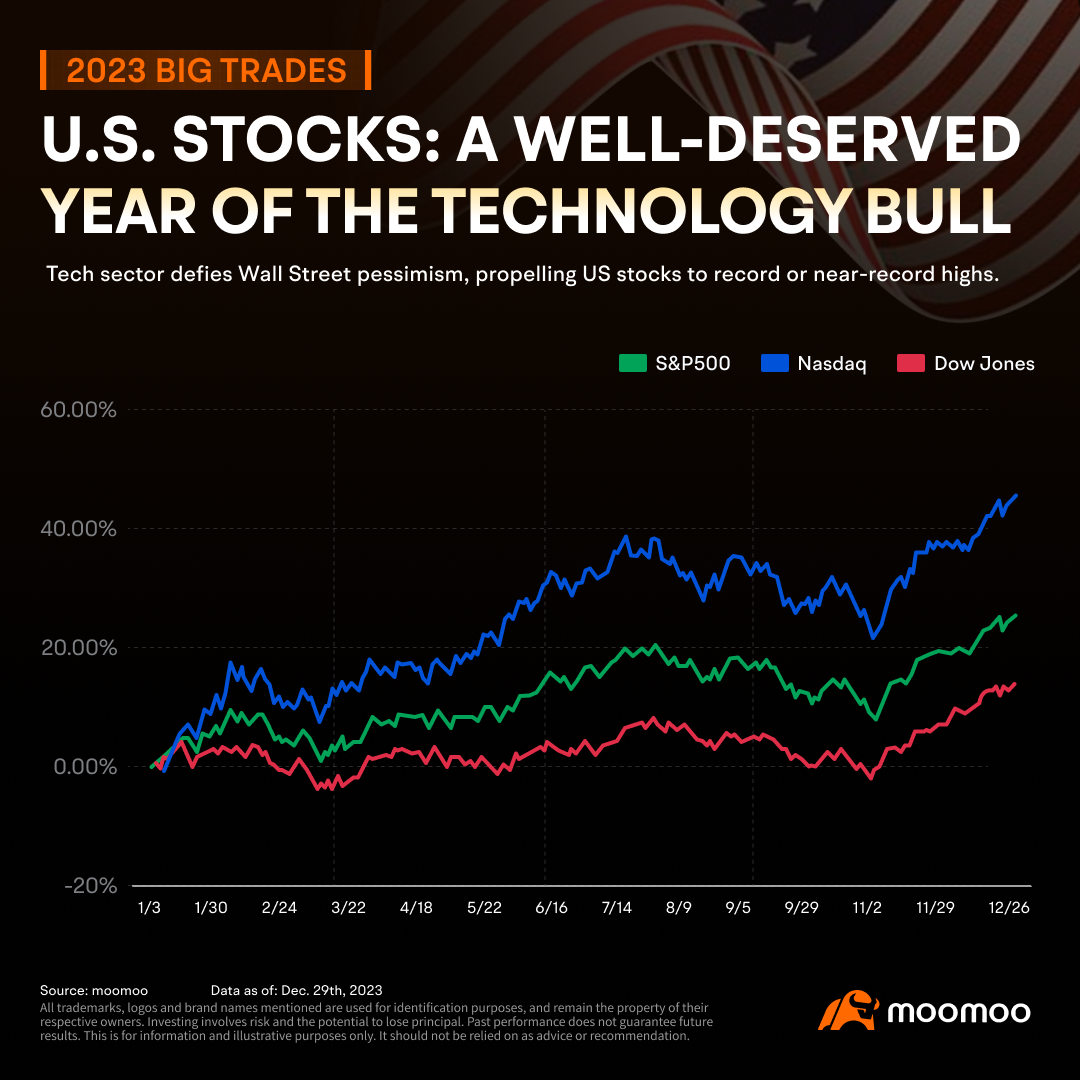

While major Wall Street investment banks held a pessimistic view towards U.S. stocks at the beginning of the year due to concerns about a weak economy and rising interest rates, the technology sector has been a key driver in propelling U.S. stocks to surge, resulting in the three major indexes either reaching or nearing record highs. In addition to the AI boom and the impressive performance of the “Magnificent Seven”, weight-loss drugs and tourism sectors have also emerged as contributing factors behind the year-long gains.

In March 2023, Silicon Valley Bank (SVB), the 16th largest bank in the U.S., encountered significant unrealized losses resulting from duration mismatch amid rapid interest rate hikes. As start-ups began to withdraw deposits, SVB was compelled to sell off assets, sparking a run and becoming a catalyst for the banking crisis in the United States. Following this, Signature Bank and First Republic Bank also faced crises. To prevent the situation from worsening, JPMorgan takes over First Republic Bank in rescue deal.

During the first ten months of this year, the U.S. Treasuries faced mounting pressure from interest rates “higher for longer”, substantial bond issuance by the Treasury Department, and ongoing reductions in holdings by many traditional large buyers. Multi-maturity U.S. Treasury yields reached a new high since the subprime mortgage crisis. However, since the end of October, as markets anticipate a shift in Fed monetary policy, the U.S. Treasury market has gradually recovered its strength. As of the latest update, the benchmark 10-year U.S. Treasury yield has sharply decreased by over 110 basis points from its peak of 5% in the year.

Following the pace of interest rate hikes and the rapid rise in short-term yields, U.S. money market fund yields are poised to reach their highest level in over fifteen years in 2023. The attraction of a risk-free rate of return of up to 5%, coupled with uncertainty surrounding the economic outlook and doubts about risk assets, has prompted investors to seek refuge in money funds once again, leading to a call that "cash is king." According to data from the Investment Company Institute, the size of U.S. money market funds reached a record high on December 6th, with total assets rising to $5.898 trillion. Nonetheless, it should be noted that as expectations for an interest rate cut by the Fed increase and market risk appetite grows, the size of monetary funds has begun to decline from its peak.

Following a prolonged period of inactivity, Bitcoin experienced a robust resurgence in 2023 and its value has surged by over 160%. Since the latter half of the year, several factors such as the conclusion of the interest rate hike cycle and prospects of interest rate cuts by the Fed, the legal resolution of some high-profile crypto cases, the anticipated approval of spot Bitcoin ETFs, and the upcoming Bitcoin halving next year have driven its price to stabilize once again above the $40,000 level after a year and a half.

After three years of consolidation, gold prices have once again surged and hit $2,100 per ounce. The strong surge in gold prices can be attributed to several factors, including safe-haven demand amidst economic recession concerns, banking crises, and geopolitical tensions. Additionally, there is continued gold-buying demand from central banks, coupled with expectations of 2024 interest rate cuts.

As 2023 comes to an end, moomoo news is grateful to have been by your side during your investment journey. We eagerly anticipate the opportunity to continue crafting captivating stories together in the years to come.

Source: Bloomberg, moomoo, Investment Company Institute, NY Times

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Ayie86 :

wiseone : while agreeing with much of what's written here, 2024 could be a very different story this time come the dawn of 2025! I think we here in the west haven't seen the worst yet, I don't trust the Feb reserve an inch, they are full of hype, the stock Market is over inflated, Governments are still printing money and borrowing and geopolitical events not just in the Ukraine and Gaza but Iran, China, Yemen, mass immigration both USA and Europe could turn economies on their head in the blink of an eye. 2023 finishes better than expected but there are dark clouds looming as we enter 2024.

Chanvei : 2024 tech bull again? ;)

101530687 wiseone: While you make a good point, shouldn't we have "confidence" in the financial markets? Aha

SpyderCall : Great read with great graphics. Reading this was like experiencing dejavous of 2023 all over again. Bravo

SpyderCall Chanvei: yup