News Decoding: US Dollar Rises for Ten Consecutive Weeks, Creating Headwinds for US Stocks

The U.S. dollar has completed its first "golden cross" since July 2021, which could be just the beginning of a larger advance. The dollar's advance, alongside rising Treasury yields, may create more problems for stocks.

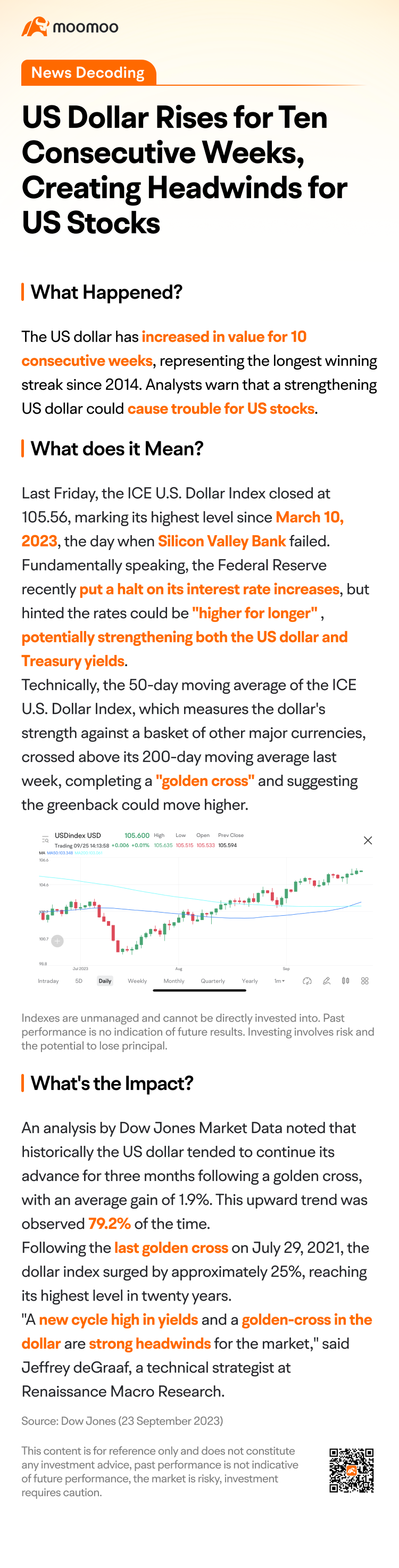

Together through today's news decoding to see. ![]()

A golden cross happens when a short-term moving average goes higher than a long-term moving average, which suggests that there might be a rally. If a golden cross shows up many indicators, it may indicate the stock could rise.

If you need assistance in identifying stocks in the US market that are likely to form a golden cross through various indicators, including MACD, KDJ, and RSI, you can try using moomoo's Stock Screener feature. Check out more in learn course!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

safri_moomoor : Yes .. Thanks moomoo give me ...

Moomoo LearnOP safri_moomoor: Your support is our long-term motivation.