RRC | Q2'23 Preview—Steady Execution, Cash Flow Miss on Mark-to-Market

SUMMARY

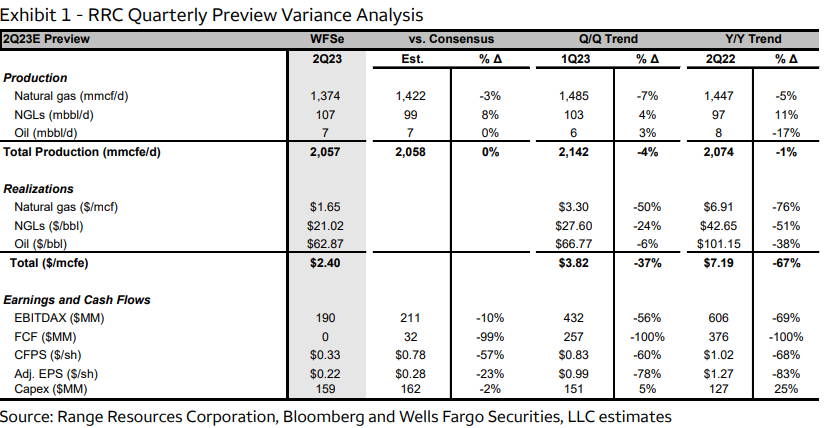

Maintain our OW rating and raise our PT (NAV based) to $33 from $31. We expect RRC to be nearly FCF neutral this quarter despite gas macro weakness, aided by RRC's low decline asset base and prudent hedging strategy.

BODY TEXT

1. Activity Cadence and Hedging Update. RRC is currently running 3 rigs in the Marcellus, but plans to drop two of them by Q4'23. Public data shows 11 / 6 gross spuds / completions through 6/30/23 and 5/03/23. Historically, the middle of the year is generally the most active for RRC, with Q2 being drilling-heavy and Q3 being completion-heavy. RRC expects ~$77MM of cash derivative settlements for Q2'23. We are modeling $132MM of cash derivative settlements for H2'23.

2. Production Trajectory. Due to planned annual midstream maintenance and completion timing, we expect total production of ~2,057 mmcfed for Q2'23, or -4% QoQ, with 3% / 3% step ups in Q3 and Q4, respectively. Overall production cadence remains similar to that of 2022 with step ups through YE. We expect Q3'23 to be the high point ($166MM) of 2023, in terms of capital spend. We note that RRC plans to drill 68 wells but TIL 61 wells in '23, which is expected to result in $30mm of DUC capex.

3. Capex & Cost Deflation. We expect FY'23 capex to be H1'23 weighted with Q2/Q3 being the most active quarters. We are modeling Q2'23/FY'23 capex of $159MM/$602MM, respectively. RRC is starting to see rig and crew costs recede slightly, with more traditional spot crew, drilling rig, and tubular/sand availability. However, material deflationary relief will not be seen until the beginning of 2024 at the earliest. We now bake in ~7% YoY cost deflation in our FY'24 capex estimate of $570MM.

4. Price Realizations & Capital Returns. We lower our pre-hedge natural gas and NGLs price realizations to $1.65/mcf (~79% of HH) and $21.02/bbl (~81% of Mt. Belvieu) respectively for Q2'23, on the weaker commodity price backdrop. We expect RRC to focus on paying down debt ($1.5bn net debt target vs. 1.6bn net debt at the end of Q1'23) before picking up activity on share repurchases. RRC has ~$1.1bn left in their current share buyback authorization (~$1.5bn program).

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment