Three strategies to ride out market turmoil

Amid expectations of aggressive interest-rate policy, there are three strategies for dealing with the turbulence

The red-hot CPI spooked markets on Tuesday.

The persistence of rising inflation has put the Fed on an aggressive path of rate hikes, cementing the prospect of a sharp hike, with 75 basis points or even 100 basis points announced at its meeting next week.

The fallout from the CPI still hangs over investors and the market performance is subdued. Obviously, more clues are needed before further decisions can be made in such a highly volatile market.

How to deal with volatile markets?

Moomoo Learn brings you three common strategies for your reference. Note that each strategy has pros and cons; make sure you understand their risks before using them to your advantage.

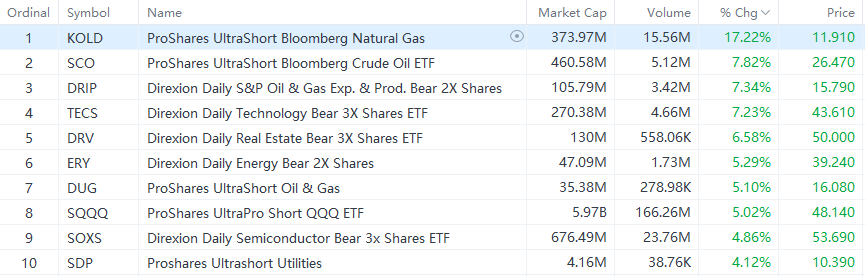

1. Hedging with inverse ETFs

Investors who are long stocks but are concerned about short-term downside risks can take a position in an inverse ETF that will appreciate when the value of the index it tracks declines.

It's worth mentioning that inverse ETFs are typically used for short-term hedging or speculation rather than long-term investment options. The ratios for such ETFs can be a bit high and eat into some of your total return.

2. Hedging with high-dividend stocks

In general, stocks with a strong history of dividend payout belong to mature companies with stable earnings, which may be less susceptible to market swings.

It's worth mentioning, however, that high dividend yields don't always signal a good investment choice.

Moomoo Learn has put together a list of dividend-paying stocks that can help you start your own search.

Criteria:

Market Cap: US stocks with a market cap above USD 10 billion

Ranked by: Average Dividend yield over the past five years

3. Hedging with options

If you are bullish on and hold a stock, you may also suffer short-term losses when the broader market pulls back.

In options trading, some investors use a portfolio of options (also called options strategies) to control or reduce the amount of risk they take.

However, there are risks in option trading, including premium loss, time value loss, high volatility, liquidity risk, delivery risk, etc. Please be sure to understand before placing an order.

You might also like:

Last but not least, if you want to effectively accumulate your investing knowledge, don't hesitate to try our exam:

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

placid Antelope_5847 : well

102568460 : Thanks for sharing these strategies. Certainly useful for both learning/references and action. Depending on one’s appetite and time horizon, one can incorporate them into their portfolio.

50 cent : why would you show inverse ETFs for things that will garunteed do the opposite in a recession. Gas, oil, commodities for God sake?

Godaddycool : no more investment.

MooMamaLlama : 3 very different strategies but yes, all with their own risk... I've just begun shorting on some of my long term hold stocks,simply to take advantage of the crazy swings. Doesn't always fall in my favour but I'm learning to manage my risk. Risk score on my other portfolio has gone from 9 to 6, on Moomoo its a lot lower as these are my long term accumulating investments. also due to fees for Au users, I began shorting my moomoo stock in my other portfolio. Does not gain back everything I lose but a few % here and there helps. plus my moomoo portfolio is still in green so I can't complain there lol

102568460 MooMamaLlama: Shorting is certainly a plan, particularly during volatile movements. Need to monitor and plan on the risks. All the best forward !

Moomoo LearnOP MooMamaLlama: A sense of risk control is good for a healthy portfolio. All the best forward.

71225386 : Ok

romantic Chipmunk_49 : nice