MGM 22Q2 Preview: Stable growth amid volatile headwinds

If you like this article, please give us a like and subscribe to 'wise shark' to get the latest information from the research report.![]()

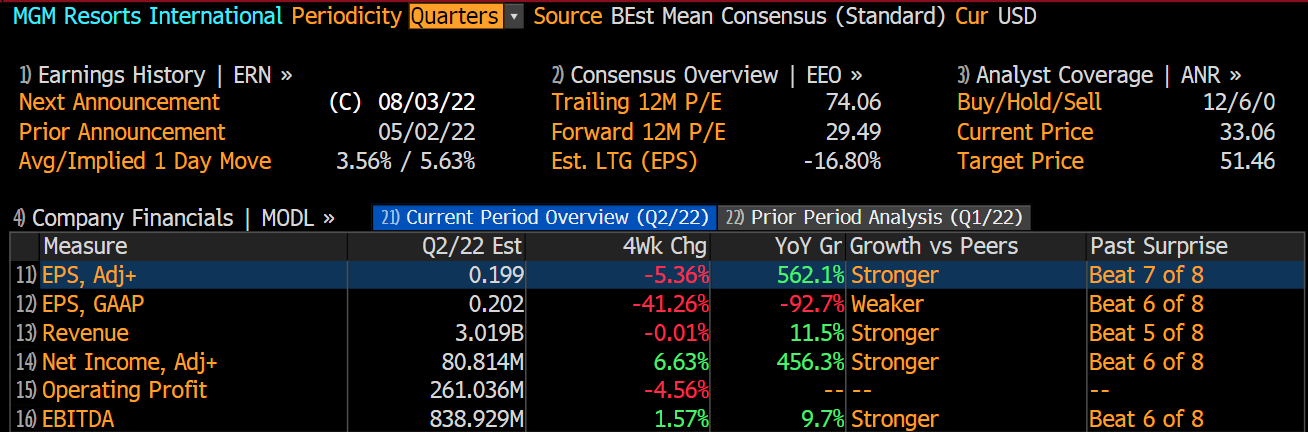

$MGM Resorts International(MGM.US$ is expected to report 22Q2 earnings after the bell on August 3rd. Bloomberg's 22Q2 consensus estimate for MGM is $3.019 billion in revenue; $80.814 million in adjusted net income; and $0.199 in adjusted earnings per share.

Key takeaways:

1. U.S. business stay strong with occupancy at 90%

Strong group booking base and leisure bookings in 2Q suggest MGM is likely to reach 90% occupancy (78% in 1Q), with 2H meeting room stays expected to reach 90% of 2019 levels. NAMA sales remained strong in April despite rising inflation. MGM is upgrading resorts, acquiring the Cosmopolitan for $1.6B and selling the old Mirage, and Las Vegas and regional EBITDAR margins are likely to stabilize above 2019 levels.

2. Regional portfolio performs well

Strong performance in April drove a small upward revision to Deutsche Bank's forecast, but growth is expected to slow. Based on observations and forecasts for the company throughout the year, more macro headwinds will emerge. The MGM regional portfolio has performed relatively well, and the underperformance of some investments may be structural given the strength of MGM Borgata and MGM Detroit over most regional markets in 2022.

Deutsche Bank believes that the two assets, Borgata MGM Hotel and Detroit MGM Hotel, will still have difficulty reaching 2019 levels in 2022 due to multiple factors.

3. Multiple positive factors are boosting hotel profits

Other potential upside drivers for Deutsche Bank's 2H22 EBITDAR and EBITDAR profit forecasts for MGM Resorts include 1. Favorable margin impact from the Cosmopolitan acquisition and synergy potential to drive upside. 2. Sales of The Mirage hotel to drive synergies in the south Las Vegas area. 3. Continued advantage inconsumption industry.

Deutsche Bank believes that there remains a focus on the significant benefits that the Las Vegas market will gain from increased gaming levels from both an EBITDAR and EBITDAR margin perspective.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Wise SharkOP : Is MGM worth investing now?$MGM Resorts International (MGM.US)$

Wise SharkOP : @Investing with moomoo

Mcsnacks H Tupack Wise SharkOP: It’s at a critical point now. It’s either going to continue up after 35.49 closing or if it doesn’t close above 35.49 it’s going to pullback to probably 29.63