Three types of inflation

As prices hit a 40-year high, inflation dominated the news.

Commodity prices, including food and energy, are the most widely cited type of inflation, but there are other forms of inflation in the wider economy.

In "New York Life Investment one minute Market introduction", we map three types of inflation and the macroeconomic factors that affect each type.

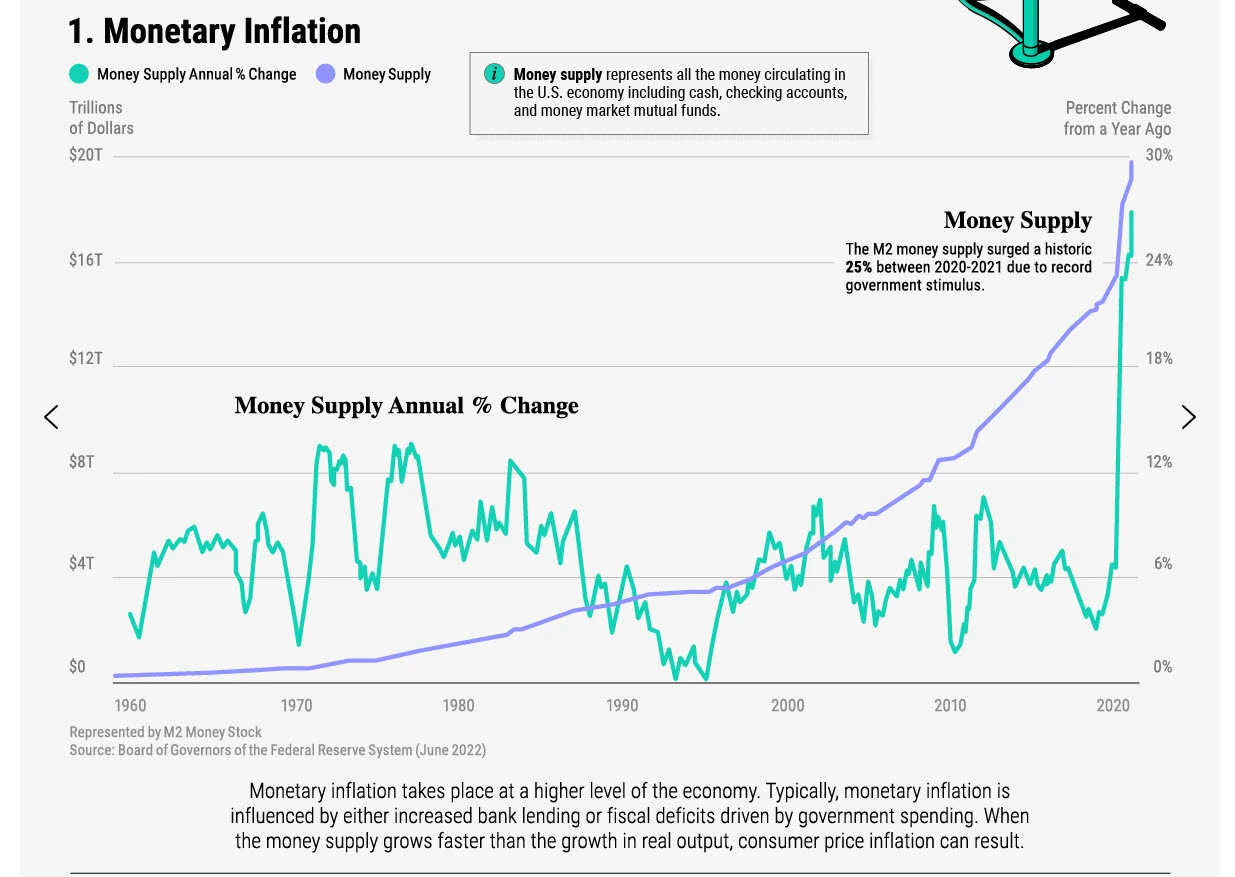

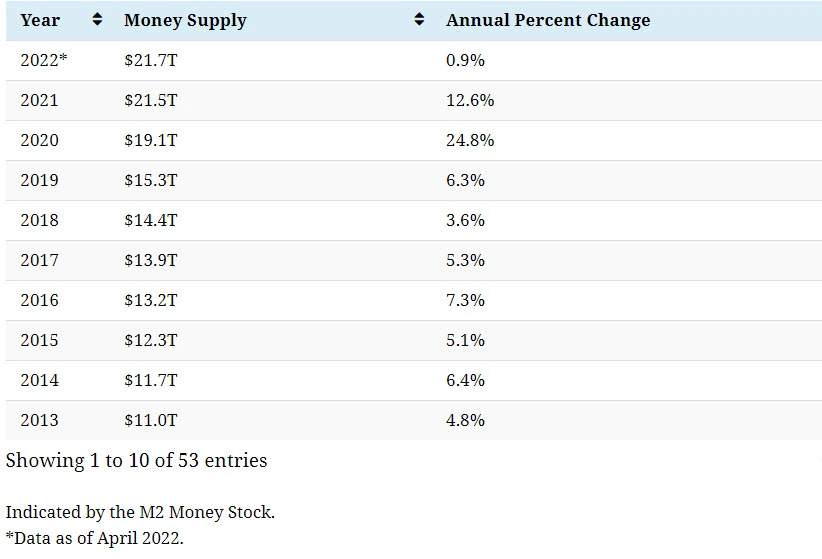

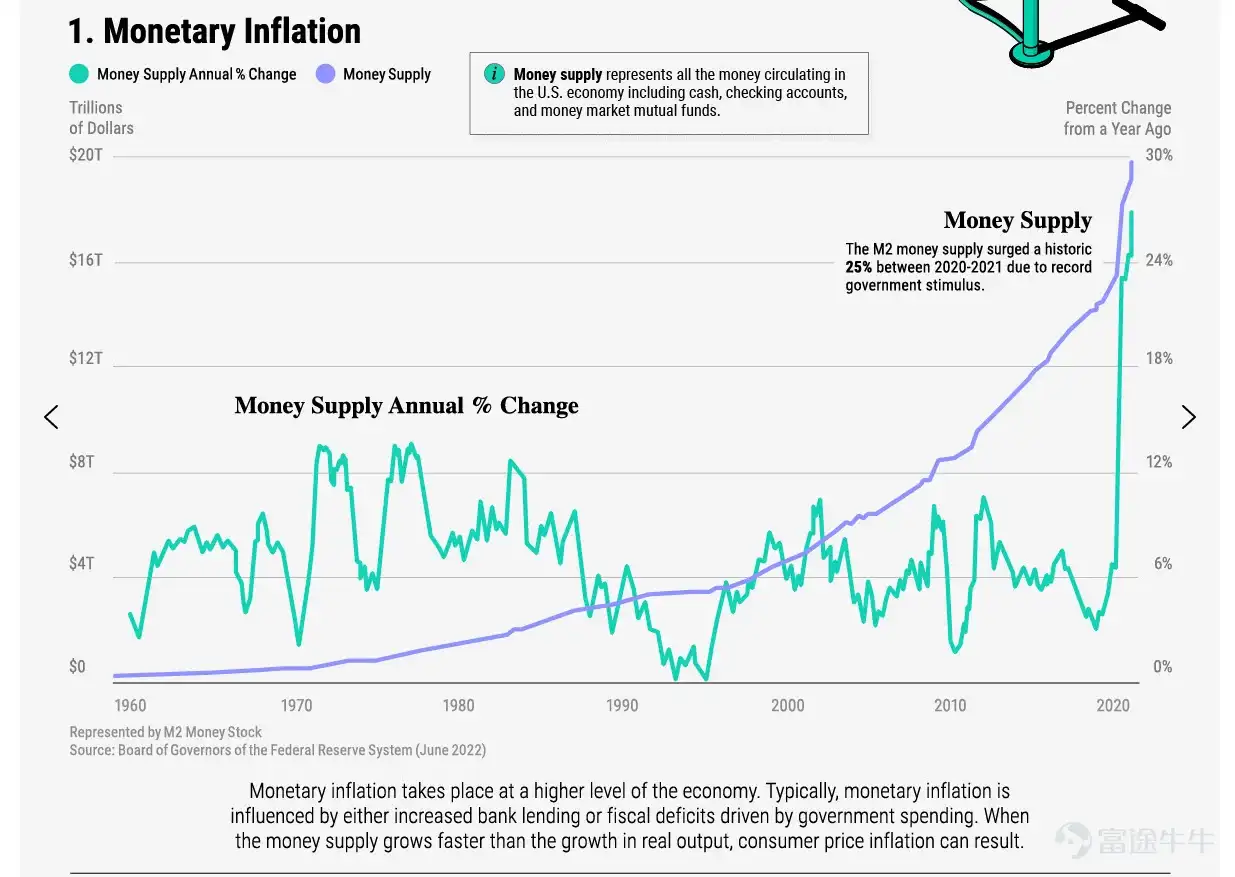

1. Monetary inflation

Monetary inflation occurs when the US money supply increases over time. This represents physical and digital currencies in circulation in the economy, including cash, checking accounts and money market mutual funds.

The central bank of the United States usually affects the money supply by printing money, buying bonds or changing bank reserve requirements. The central bank controls the money supply to stimulate the economy or curb inflation and keep prices stable.

In response to the COVID-19 crisis, between 2020 and 2021, the money supply increased by about

25%, a record. Since then, as the economy showed signs of strength, the Fed began to scale back its bond purchases.

25%, a record. Since then, as the economy showed signs of strength, the Fed began to scale back its bond purchases.

It is worth noting that, in theory, the growth of the money supply faster than the growth rate of real output may lead to a rise in consumer prices, especially when the velocity of money circulation (the speed of money transactions) is high. The reason is that there is more money chasing the same number of goods, which eventually leads to higher prices.

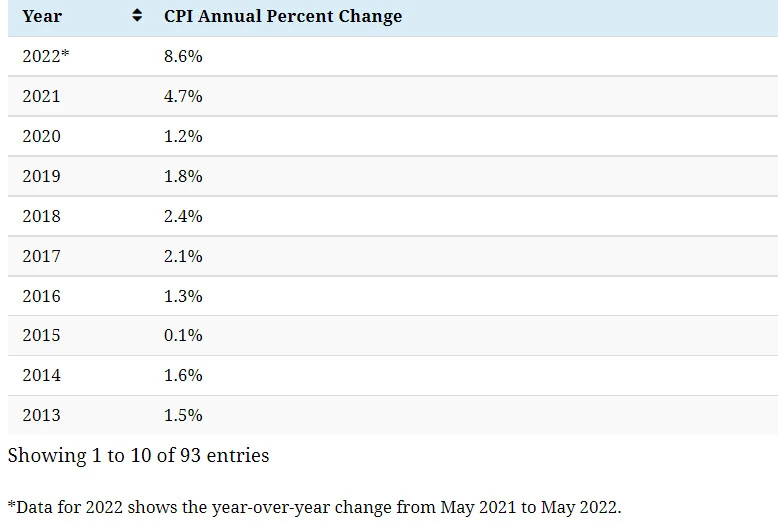

two。 Consumer price inflation

Consumer price inflation occurs when the prices of goods and services rise. It is usually measured by the Consumer Price Index (CPI), which shows an increase in the average price of a basket of goods, such as food, clothing and housing.

Supply chain problems, geopolitical events, money supply and consumer demand can all affect consumer price inflation.

CPI rose 8.6% in May from a year earlier, the highest level in 40 years. Conflict between Russia and Ukraine

COVID-19 has caused widespread disruptions in the supply chain from oil to wheat, leading to increased global price pressures.

COVID-19 has caused widespread disruptions in the supply chain from oil to wheat, leading to increased global price pressures.

When consumer price inflation is overheated, the central bank may raise interest rates to reduce spending and cool prices.

3. Asset price inflation

Asset price inflation represents the increase in the prices of stocks, bonds, real estate and other financial assets over time. Although there are several ways to show asset price inflation, we will use household net worth as a percentage of GDP.

Usually a low interest rate environment creates an enabling environment for asset prices. This can be seen over the past decade because low borrowing costs complement rising asset prices and strong investor confidence.

In 2021, the percentage of household net worth in GDP is 620%.

In 2021, the percentage of household net worth in GDP is 620%.

How does the type of inflation affect you?

With monetary inflation, businesses and consumers can spend more money, which could stimulate demand and further increase inflation in the economy as a whole.

However, the extent of this impact on consumer price inflation is unknown. Money supply has surged over the past decade, but consumer price inflation has remained relatively stable. On the contrary, the supply shock brought about by the conflict between COVID-19 and Russia and Ukraine has a more direct impact. The impact of commodity scarcity makes prices more sensitive to demand. This can be seen when gasoline prices hit an all-time high.

In terms of asset price inflation a significant increase in the money supply and low interest rates may be behind the rise in asset prices as well as other variables. However, as the Fed takes a tougher stance on monetary policy, the future of asset price inflation remains to be seen.

摘自Dorothy Neufeld June 16 2022

Visualizing the Three Different Types of

Inflation

Inflation

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

BILL DING : Robbing banks is now a reason to survive. Inflation makes it impossible for people to endure the time it takes to change, strong national policies, and the effects of various human factors, where does the money go. 。

Robbing banks is now a reason to survive. Inflation makes it impossible for people to endure the time it takes to change, strong national policies, and the effects of various human factors, where does the money go. 。