Another powerful indicator for your successful trading

In the previous TA challenges, we had learned the use of trading indicators such as MA, MACD, EMA, DMI, and BB. In this new session, we're going to explore the use of the relative strength index(RSI). With RSI, you can better evaluate whether a stock is in the overbought/oversold zone.

Let's tap the following post title to start learning now!

When finishing learning, don't forget to post your notes in the discussion to win a reward. Besides, you may receive advice and kudos from your fellow mooers!

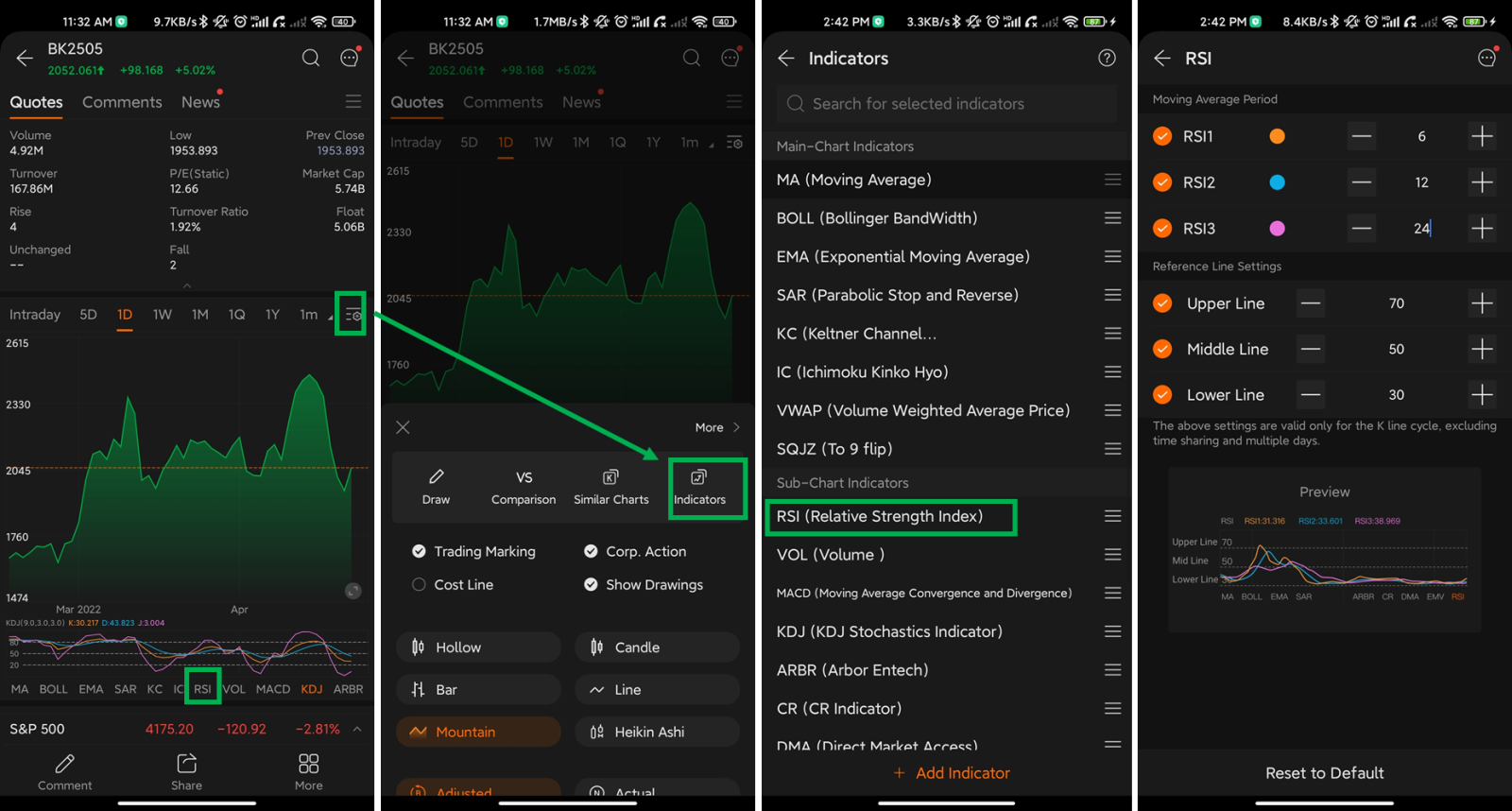

Where is the RSI indicator? Follow the steps below to use RSI.

Rewards:

1. USD 20 Stock Cash Coupon

We will select 6 winners of the featured posts regarding quality, originality, indicators, charts, and user engagement.

*What's stock cash coupon: https://www.moomoo.com/support/topic527

We will select 6 winners of the featured posts regarding quality, originality, indicators, charts, and user engagement.

*What's stock cash coupon: https://www.moomoo.com/support/topic527

2. 88 Points

Posts with a minimum of 20 words & analytical charts will be rewarded with 88 points.

*The above rewards are mutually exclusive.

Duration: Now – May 8, 2022 11:59 PM SGT

T&C:https://www.moomoo.com/support/topic577

Posts with a minimum of 20 words & analytical charts will be rewarded with 88 points.

*The above rewards are mutually exclusive.

Duration: Now – May 8, 2022 11:59 PM SGT

T&C:https://www.moomoo.com/support/topic577

Disclaimer: Moomoo is a financial information and trading app offered by Moomoo Inc.

In the U.S., investment products and services on moomoo are offered by Futu Inc., regulated by the U.S. Securities and Exchange Commission (SEC). Futu Inc. is a member of Financial Industry Regulatory Authority (FINRA) and Securities Investor Protection Corporation (SIPC).

In Singapore investment products and services are offered through Futu Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS). Moomoo Inc., Futu Inc., Futu Singapore Pte. Ltd. and Futu Securities (Australia) Ltd are affiliated companies. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Australia, financial products and services on moomoo are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and Investment Commission (ASIC). Please read and understand our Financial Services Guide, Terms and Conditions, Privacy Policy and other disclosure documents which are available on our websites https://www.futuau.com and https://www.moomoo.com/au

This article is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this video is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Rocket Man : Agar agar see. Can le. Not all 100% accurate one

Milk The Cow Rocket Man:

Milk The Cow Rocket Man:

Tuyea :

102216020 : very useful indicator

moneysnipper : The basic logic of rsi is that if you go up more, you will fall, and if you fall too much, you will go up. Can be used to determine the investment, after the investment, do not look at the k line, do not look at the price, only look at the indicators, because the indicators will not be new low, but the stage is low.

WolfOfWallStreet Tuyea:

Tyler Jacks : you can tell my the mcad. can I get the 20usd coupon

treydongui : I usually set my RSI within 25 points of top or bottom so it's a little extra oversold or overbought when I use it RSI. in stocks this is a very useful indicator used in conjunction with others. but experiences showed me that cryptocurrency traders value this indicator more than any other especially when cryptocurrencies are so young and volatile right now they're hard to chart accurate future movements with consistent accuracy. Reason being; 1.)very little history/data to go on, 2.) small trading volumes compared to the level of adoption and growth in crypto market over the last year. and the early days in crypto would make the "Wild Wild West wear a dress" ;) Early crypto was riffe with scams, pump n dumps, many exchanges faking volume, super high business failure rate,and last but not least IT WASN'T REGULATED (A CRYPTO CURSE WORD, SHHH ;) one thing I found interesting that I didn't know until after a good while was to watch to see if RSI is trending in the top half or bottom half consistently to decipher if the trend is bullish or bearish in some situations. I had heard of this when I went thru every indicator i could find, researched and used them individually. I devoted my entire last year to having a basic understanding of every indicator I can find pretty much LOL i gained some knowledge but the experience was just as important. This year I had gone back to normal, and it DEFINITELY has been very telling in more ways than i could think of I'm sure.

thank you @Meta Moo for creating this course and sharing your wisdom. not to mention providing an awesome opportunity as you guys always have since my first day here. keep being you and wow the app is really innovative. you guys are killing it congrats