Top 5 ETF investing ideas as risk aversion grows

Nobody knows for sure how the Russia-Ukraine war will end![]() . The only certainty is greater uncertainty. What is clear is that inflation and interest rates are rising, geopolitical risk is growing and heightened market volatility seems likely.

. The only certainty is greater uncertainty. What is clear is that inflation and interest rates are rising, geopolitical risk is growing and heightened market volatility seems likely.

When risk aversion grows, what companies can still do well as inflation and interest rates increase![]() ? Investors are using ETFs that pinpoint the strongest companies or those with less volatility.

? Investors are using ETFs that pinpoint the strongest companies or those with less volatility.

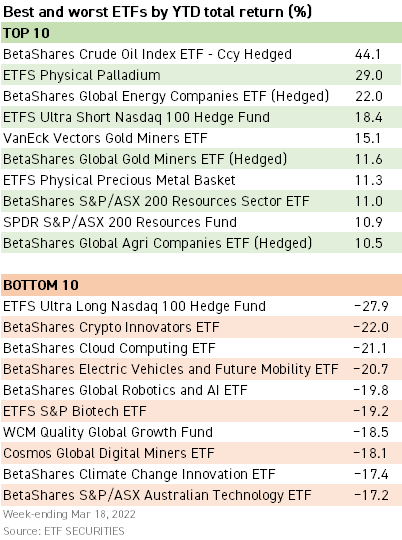

Traders who piled into ETFs over oil, energy stocks and gold paid off. The 10 top ETFs have returned an average 18 per cent since January. They include commodity and resource funds, and inverse ETFs that rise when markets fall.

When risk aversion grows, what companies can still do well as inflation and interest rates increase

Traders who piled into ETFs over oil, energy stocks and gold paid off. The 10 top ETFs have returned an average 18 per cent since January. They include commodity and resource funds, and inverse ETFs that rise when markets fall.

How long-term investors can use ETFs to capitalise on market volatility this year? Let's jump into the 5 ideas provided by ETF issuers and fund managers![]() . If you're enjoying this article so far please make sure to give a like

. If you're enjoying this article so far please make sure to give a like![]() and please consider following this account because I write articles about investing every single week.

and please consider following this account because I write articles about investing every single week.

1. Food

The war sparked fears of supply disruption from Russia, the world's largest wheat exporter. BetaShares CEO Vynokur notes rising interest in the $BetaShares Glb Agltr Coms ETF-Ccy Hdg(FOOD.AU$. The ETF tracks an index of 56 of the world's largest agriculture and farming-related companies. A third of the ETF is invested in fertiliser companies. FOOD returned almost 20 per cent over one year to end-February 2022.

2. Clean Energy

VanEck's Neiron believes investors should consider clean-energy exposure. "The invasion of Ukraine will encourage European countries to reduce their reliance on gas and oil supplies from Russia and quicken their adoption of clean energy," he says.

The $VanEck Global Clean Energy ETF(CLNE.AU$ was down almost 15 per cent over six months to end-February 2022. CLNE invests in 30 of the world's largest companies in clean-energy production, technology and equipment. As the recent performance gap between fossil-fuel producers and clean energy companies widens, the case to focus on renewables is strengthening.

3. Precious metals

ETF Securities' Chugh says more clients have allocated funds into the ETFS Physical Gold ETF as a hedge against inflation and geopolitical volatility. There's also rising demand for the ETFS Physical Precious Metal Basket.

This ETF provides exposure to gold, silver, palladium and platinum. Palladium, used in catalytic converters for car exhausts, hit a record high this month on supply fears. Russia is a major producer of palladium and platinum.

4. Smart-beta yield

ETFs investing in companies that pay higher dividends and exhibit lower volatility are another option for income investors. The $Global X S&P 500 High Yield Low Volatility ETF(ZYUS.AU$ is an example.

ZYUS invests in 50 US stocks that meet its dividend and volatility criteria. To aid diversification, each stock is capped at 3 per cent of the fund, and no sector can account for more than 25 per cent.

5. Cash

A higher allocation to cash – accompanied by a larger allocation to growth assets to maintain real returns – means more firepower to buy equities when markets correct, as they did in January and February.

The iShares Core Cash ETF or BetaShares High Interest Cash ETF pay slightly lower returns than term deposits. But their advantage is liquidity. Unlike term deposits, which lock money away for years, cash ETFs can be sold quickly in volatile markets.

Disclaimer: I'm not a financial advisor and this is not a personal financial advice. It’s important that you do your own research!

1. Food

The war sparked fears of supply disruption from Russia, the world's largest wheat exporter. BetaShares CEO Vynokur notes rising interest in the $BetaShares Glb Agltr Coms ETF-Ccy Hdg(FOOD.AU$. The ETF tracks an index of 56 of the world's largest agriculture and farming-related companies. A third of the ETF is invested in fertiliser companies. FOOD returned almost 20 per cent over one year to end-February 2022.

2. Clean Energy

VanEck's Neiron believes investors should consider clean-energy exposure. "The invasion of Ukraine will encourage European countries to reduce their reliance on gas and oil supplies from Russia and quicken their adoption of clean energy," he says.

The $VanEck Global Clean Energy ETF(CLNE.AU$ was down almost 15 per cent over six months to end-February 2022. CLNE invests in 30 of the world's largest companies in clean-energy production, technology and equipment. As the recent performance gap between fossil-fuel producers and clean energy companies widens, the case to focus on renewables is strengthening.

3. Precious metals

ETF Securities' Chugh says more clients have allocated funds into the ETFS Physical Gold ETF as a hedge against inflation and geopolitical volatility. There's also rising demand for the ETFS Physical Precious Metal Basket.

This ETF provides exposure to gold, silver, palladium and platinum. Palladium, used in catalytic converters for car exhausts, hit a record high this month on supply fears. Russia is a major producer of palladium and platinum.

4. Smart-beta yield

ETFs investing in companies that pay higher dividends and exhibit lower volatility are another option for income investors. The $Global X S&P 500 High Yield Low Volatility ETF(ZYUS.AU$ is an example.

ZYUS invests in 50 US stocks that meet its dividend and volatility criteria. To aid diversification, each stock is capped at 3 per cent of the fund, and no sector can account for more than 25 per cent.

5. Cash

A higher allocation to cash – accompanied by a larger allocation to growth assets to maintain real returns – means more firepower to buy equities when markets correct, as they did in January and February.

The iShares Core Cash ETF or BetaShares High Interest Cash ETF pay slightly lower returns than term deposits. But their advantage is liquidity. Unlike term deposits, which lock money away for years, cash ETFs can be sold quickly in volatile markets.

Disclaimer: I'm not a financial advisor and this is not a personal financial advice. It’s important that you do your own research!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

CashCowMoo : Thanks for sharing

Amani koalaOP CashCowMoo: you are welcome! It's my passion to share investment insights

Bruzzix : Good read

Amani koalaOP Bruzzix: thanks!

JM investor : thanks for sharing! I found that it works good if we can hedge the etf with each other too. like combine food or precious metals etf with technology etf

Amani koalaOP JM investor: great point!