The Short Interest Buildup

$Palantir(PLTR.US$ Before we dive deep into the analysis, I quickly want to explain to the uninitiated that short interest is basically the aggregate number of short positions that are open and are yet to be covered. A dramatic rise in the metric indicates that market participants are placing bearish bets against a particular stock as, perhaps, they forecast the stock to materially decline in value going forward. Conversely, a significant drop in the metric indicates that short-side traders actively wound up their positions as, perhaps, they feel the stock is fairly or undervalued. So, short interest is essentially a general indicator, but not a sure shot predictor, of the Street's ever evolving market sentiment.

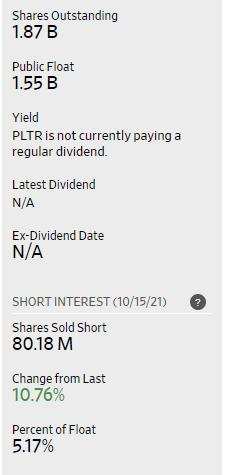

Coming back to Palantir, its short interest for the cycle ending October 15 stood at 80.18 million, up 10.8% sequentially. The short interest figure may seem huge when seen in isolation, but it's actually not. To put things in perspective, Palantir has around 1.55 billion floating shares which means that just about 5.2% of its entire public float had been shorted at the end of the last cycle. This isn't large enough to move the stock price or to cause market-wide panic. As a rule of thumb, I consider short interest figure to be high once it accounts for 10% or more of a company's public float.

To confirm if Palantir's short interest is indeed low, I pulled up the relevant data for 40 other US-listed software infrastructure stocks. There are two very important items that tell us just that. First, note in the table below that Palantir's short interest as a percentage of its public float, isn't very high by industry standards. There are stocks that have seen a major buildup in short bets against them, and then there are names that have virtually no shorting activity going on. It's evident that Palantir is positioned towards the lower end of this spectrum, which should come as a relief for its shareholders.

Secondly, the fee rate column highlights the cost of borrowing Palantir's shares for shorting purposes. Note that it's just 0.3% for Palantir whereas the figure goes up to 8.3% for another more shorted stock. Palantir's stock is available for shorting purposes at a very low cost and yet market participants aren't betting against it. If the bearish narratives surrounding the company were truly legitimate, and its shares were poised to fall by a significant degree, then market participants would be actively shorting the stock in a bid to profit from this near-certain event. But we clearly don't see that happening here.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Petiedawgs : Doubt this one dips below twenty buy can remain low twenties for a few months. If pressed I'd buy vs sell.

ShouldISell : Doubt this one dips below twenty buy can remain low twenties for a few months. If pressed I'd buy vs sell.

K Cheong : o.k. o.k. !!! it's me!!! I have been selling weekly OTM covered calls but using the premiums to add more shares.. kind of a short to buy long...

JohnnyTrader : I want to learn how to do that... Thanks...

JohnnyTrader : More shorts is a great news! Bigger, tighter and persistent ‘squeeze’ coming in future! Let’s talk in 1 to 2 years.