A brief overview of Algo Trading

1. What is algorithmic trading

To put it simply, algorithmic trading is a process of utilizing one’s investment philosophies and strategies by means of computer technologies and certain mathematic models.

Instead of relying on one’s personal feelings to manage assets, algorithmic trading relies on mathematical computations and statistics to form quantitative models and to process information through computers in order to achieve automatic or semi-automatic trading.

2. How to use Moomoo Algo feature

2.1 Introduction

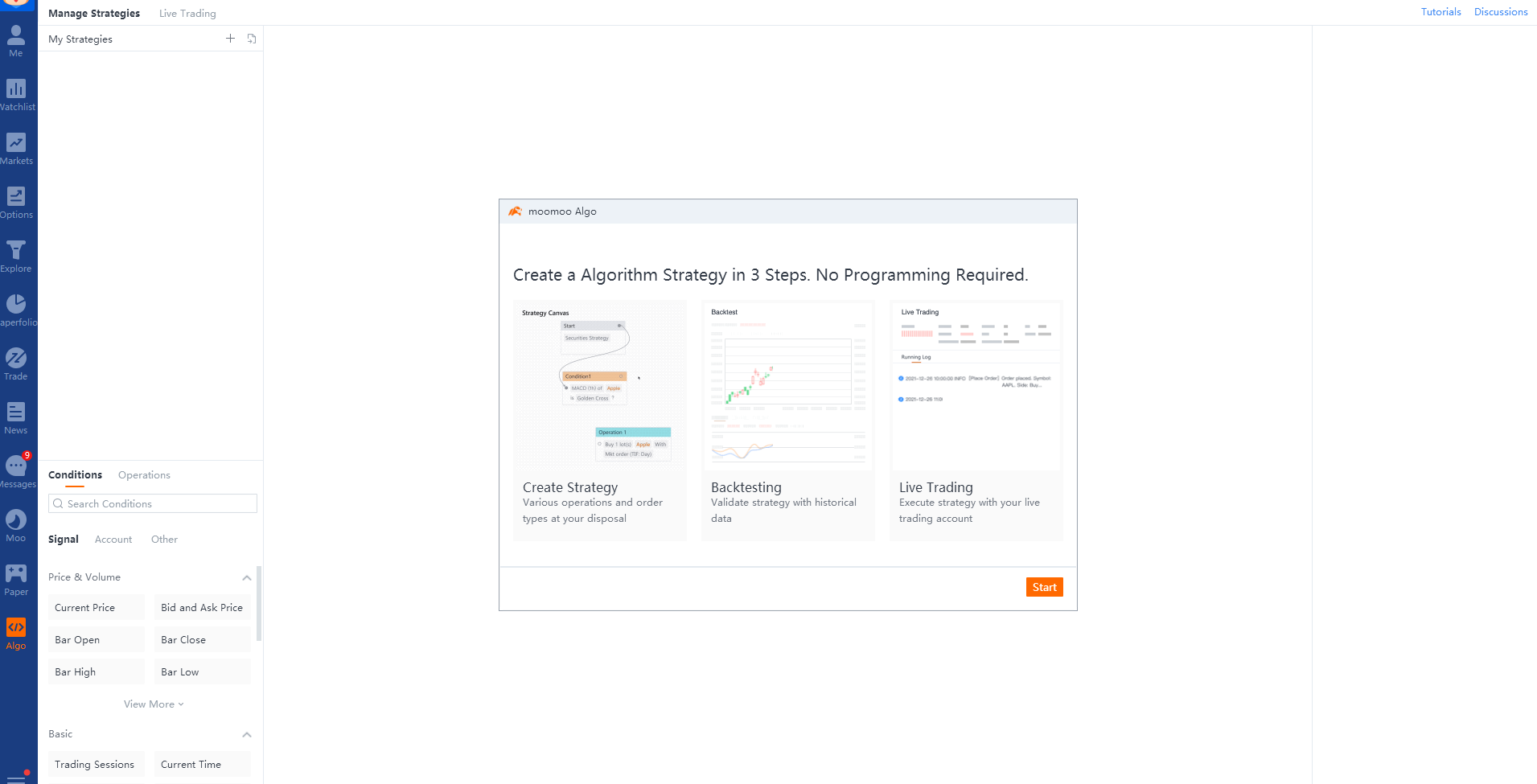

Open Moomoo in Windows and click the "Algo" tab on the left.

The interface is designed to be easy. You don’t need to program by yourself in the whole process. All it takes is a few simple steps of clicking and dragging to set up a Algo trading strategy and carry out backtest and live trading.

2.2 Onboarding task strategy

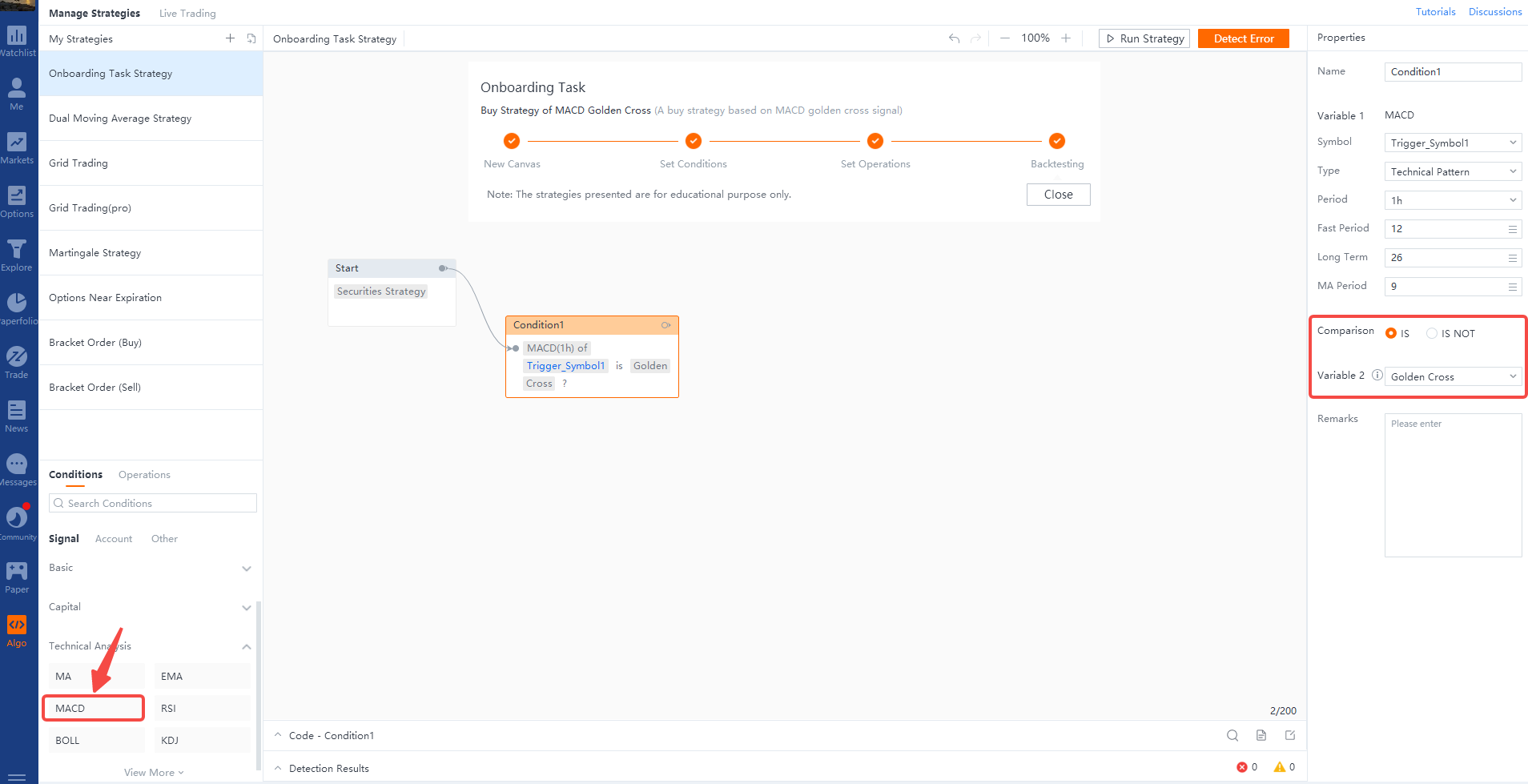

The onboarding task will be initiated once you click the "Algo" tab for the first time.

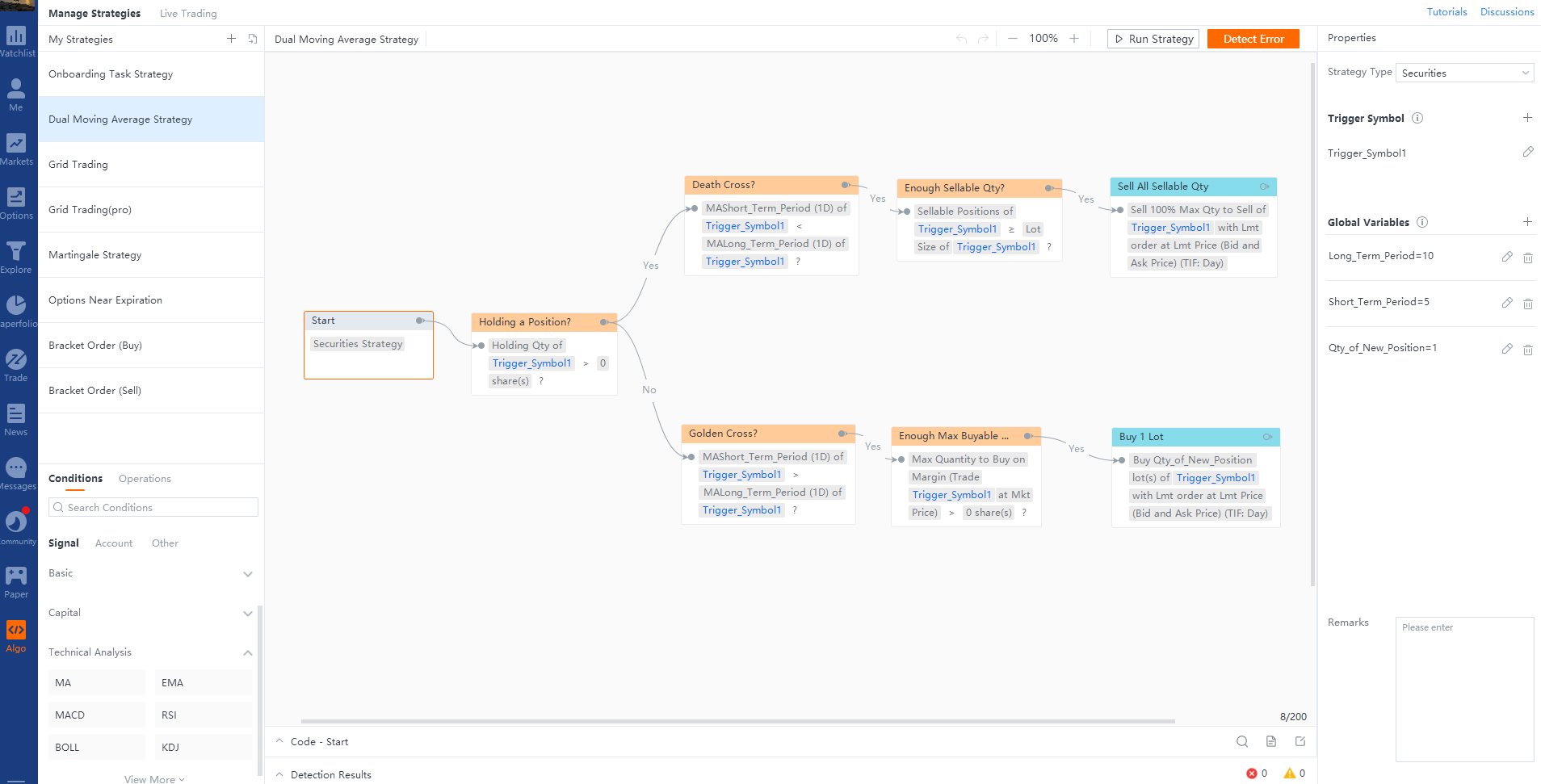

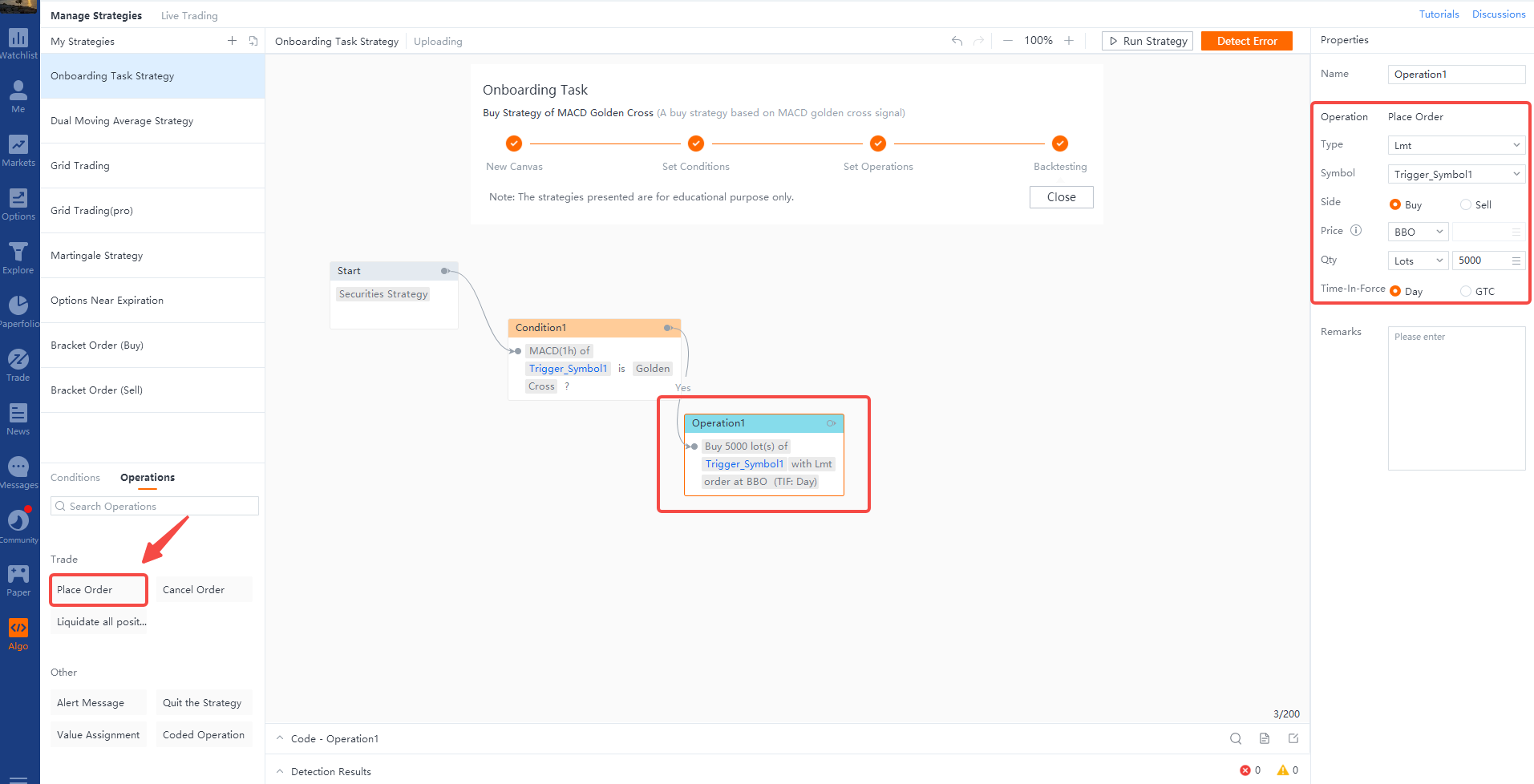

All you need is a Condition and an Operation to establish a simple strategy. The strategy includes 2 important elements: what condition to meet and what operation to execute.

For example, in the onboarding task, the strategy will determine whether a golden cross occurs in the MACD of Trigger Symbol 1.

If yes, a market order of 5,000 board lots will be placed; if no, no operation will be executed.

Moving Average Convergence/Divergence (MACD): MACD measures the divergence or convergence between two moving averages. It's considered a momentum indicator that can help spot changes in the strength, direction, and duration of a price trend.

Losses can happen more quickly with Algo and algorithmic trading compared to other forms of trading. Trading financial markets are inherently risky. Thus, an important component of Algoitative trading systems is risk management. Risk is essentially anything that can interfere with the successful performance of a Algoitative trading system. In the market, Algos face different types of risks. There is, of course, market risk, which means that price changes of underlying financial assets can be fast and dynamic such that losing trades are generated. But this is not the only risk Algos are exposed to. There is also capital allocation, technology risk, broker risk, and even personality risk (but this can be mitigated with automation). Automatic investment strategies do not ensure a profit or protect against losses.

Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.