Guangdong Orient Zirconic Ind Sci & Tech Co.,Ltd (SZSE:002167) shares have continued their recent momentum with a 33% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

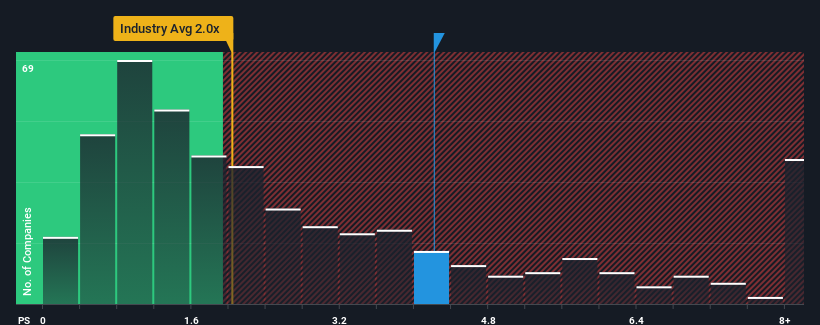

Since its price has surged higher, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2x, you may consider Guangdong Orient Zirconic Ind Sci & TechLtd as a stock to avoid entirely with its 4.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Guangdong Orient Zirconic Ind Sci & TechLtd's P/S Mean For Shareholders?

The revenue growth achieved at Guangdong Orient Zirconic Ind Sci & TechLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Guangdong Orient Zirconic Ind Sci & TechLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Guangdong Orient Zirconic Ind Sci & TechLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Guangdong Orient Zirconic Ind Sci & TechLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. This was backed up an excellent period prior to see revenue up by 77% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 23% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Guangdong Orient Zirconic Ind Sci & TechLtd is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Guangdong Orient Zirconic Ind Sci & TechLtd's P/S Mean For Investors?

The strong share price surge has lead to Guangdong Orient Zirconic Ind Sci & TechLtd's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Guangdong Orient Zirconic Ind Sci & TechLtd revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware Guangdong Orient Zirconic Ind Sci & TechLtd is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.