Unfortunately for some shareholders, the Shenzhen Baoming Technology Co.,Ltd. (SZSE:002992) share price has dived 27% in the last thirty days, prolonging recent pain. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

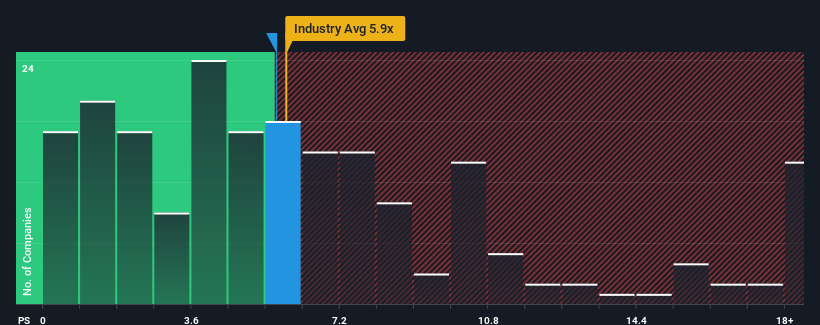

Even after such a large drop in price, it's still not a stretch to say that Shenzhen Baoming TechnologyLtd's price-to-sales (or "P/S") ratio of 5.7x right now seems quite "middle-of-the-road" compared to the Semiconductor industry in China, where the median P/S ratio is around 5.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Shenzhen Baoming TechnologyLtd Performed Recently?

Recent times have been advantageous for Shenzhen Baoming TechnologyLtd as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Baoming TechnologyLtd.Do Revenue Forecasts Match The P/S Ratio?

Shenzhen Baoming TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Still, revenue has fallen 11% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 31% as estimated by the sole analyst watching the company. With the industry predicted to deliver 34% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Shenzhen Baoming TechnologyLtd's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Shenzhen Baoming TechnologyLtd's P/S

Shenzhen Baoming TechnologyLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Shenzhen Baoming TechnologyLtd's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Shenzhen Baoming TechnologyLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.