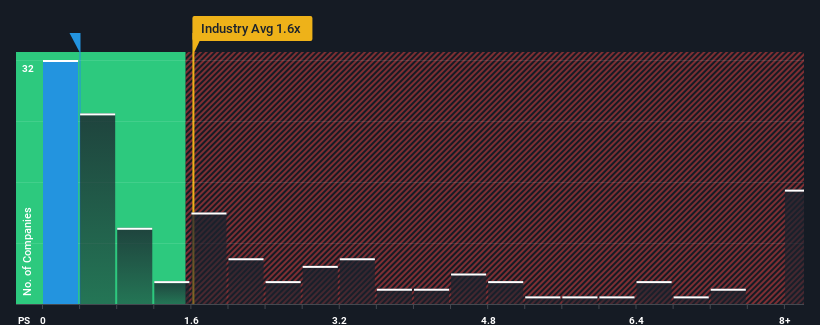

You may think that with a price-to-sales (or "P/S") ratio of 0.4x Shenzhen Overseas Chinese Town Co.,Ltd. (SZSE:000069) is a stock worth checking out, seeing as almost half of all the Real Estate companies in China have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Shenzhen Overseas Chinese TownLtd's Recent Performance Look Like?

Shenzhen Overseas Chinese TownLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenzhen Overseas Chinese TownLtd.Is There Any Revenue Growth Forecasted For Shenzhen Overseas Chinese TownLtd?

In order to justify its P/S ratio, Shenzhen Overseas Chinese TownLtd would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. This means it has also seen a slide in revenue over the longer-term as revenue is down 32% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.5% per year during the coming three years according to the four analysts following the company. With the rest of the industry predicted to shrink by 0.7% each year, it's set to post a similar result.

In light of this, the fact Shenzhen Overseas Chinese TownLtd's P/S sits below the majority of other companies is unanticipated but certainly not shocking. We think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenzhen Overseas Chinese TownLtd's analyst forecasts revealed despite having an equally shaky outlook against the industry, its P/S much lower than we would have predicted. There could be some further unobserved threats to revenue stability preventing the P/S ratio from matching the outlook. Perhaps there is some hesitation about the company's ability to resist further pain to its business from the broader industry turmoil. At least the low P/S ratio helps mitigate the risk of the share price dropping substantially, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shenzhen Overseas Chinese TownLtd you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.