The February consumer price inflation report came in hotter than expected, but traders shrugged off the number and indulged in buying, anticipating that the central bank would lower the Fed funds rate this year. However, comments from economist and gold bull Peter Schiff on Tuesday tell an altogether different story.

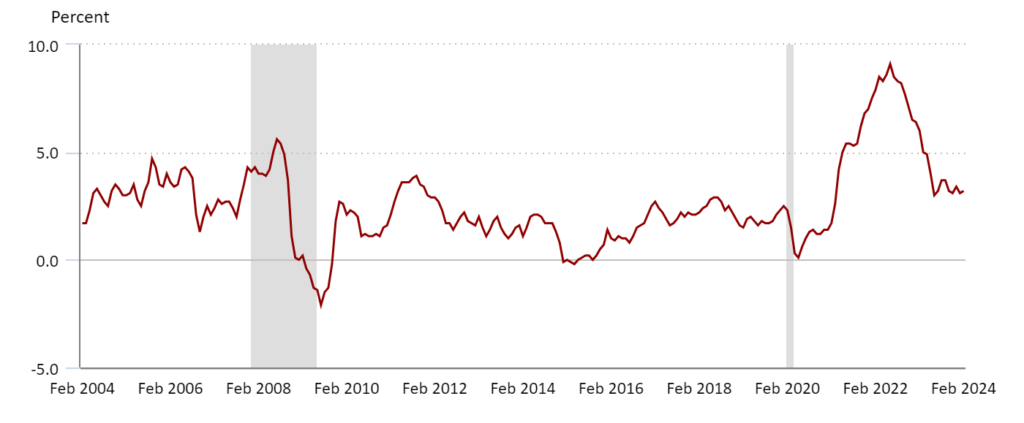

What Happened: According to Schiff, the February inflation number confirms that the disinflation trend ended months ago. He stated in a post on X that inflation bottomed and was now on the rise.

Source: Bureau of Labor Statistics

"Rather than falling back down to the #Fed's 2% target, the rate is far more likely to head back up to 9%, then ultimately breaking into double digits," the economist warned.

In the current cycle, headline annual inflation peaked at 9.1% in June 2022 and was on a decelerating trend until June 2023. It has been moving sideways since then.

Schiff criticized the Federal Reserve for its inaccurate inflation forecasts. "The #Fed is as wrong now about #inflation on track to return to 2% as it was about the uptick in inflation being transitory in 2021," he remarked.

He took potshots at Fed Chair Jerome Powell for his ineffectiveness in reining in inflation. "The Fed's only real means of fighting inflation is to talk the talk. #Powell just hopes that markets don't figure out that he can't walk the walk," he added.

Best Inflation Stocks

Extravagant Spending: Schiff also commented on the February federal budget released on Tuesday. He noted that the budgetary deficit climbed 12.9% year-over-year to $296 billion, marking the highest February deficit ever since February 2021 during the COVID-19 pandemic.

Compared to February 2020, spending was up 50%, he observed.

"Most shockingly, the government borrowed more money than it collected in taxes," he emphasized.

Why It's Important: The Fed's fixation on inflation suggests that the central bank may not be ready to cut interest rates until it sees the indicator heading sustainably toward its 2% target.

Much of the increase in inflation in February was due to higher gasoline and shelter costs. LPL Chief Economist Jeffrey Roach remarked, "Outside of shelter and gas prices, inflation would be benign."

"The long-term disinflation trajectory has probably not changed, but the path to the Fed's 2% target will be choppy."

Despite the stickiness of inflation, the economist views the current Fed policy as clearly restrictive.

In the market, the iShares TIPS Bond ETF (NYSE:TIP), which tracks inflation-protected U.S. Treasury bonds, closed Tuesday's session down 0.20 at $107.19, according to Benzinga Pro data.

Photo via Shutterstock.