Kunshan Huguang Auto Harness Co.,Ltd. (SHSE:605333) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 5.3% isn't as attractive.

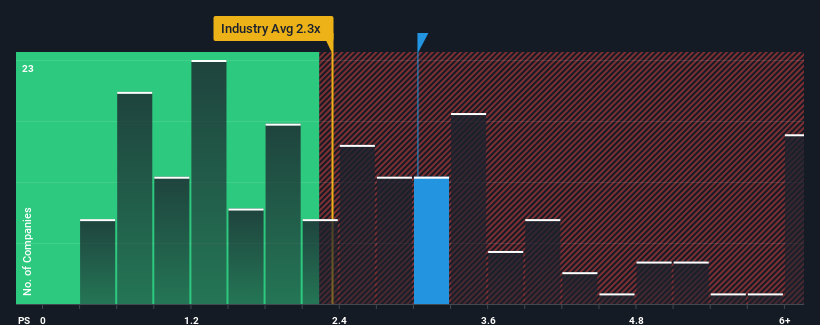

Since its price has surged higher, you could be forgiven for thinking Kunshan Huguang Auto HarnessLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3x, considering almost half the companies in China's Auto Components industry have P/S ratios below 2.3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has Kunshan Huguang Auto HarnessLtd Performed Recently?

Recent times haven't been great for Kunshan Huguang Auto HarnessLtd as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Kunshan Huguang Auto HarnessLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Kunshan Huguang Auto HarnessLtd would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.8%. This was backed up an excellent period prior to see revenue up by 129% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 70% over the next year. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

With this information, we can see why Kunshan Huguang Auto HarnessLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Kunshan Huguang Auto HarnessLtd's P/S?

The large bounce in Kunshan Huguang Auto HarnessLtd's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Kunshan Huguang Auto HarnessLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Kunshan Huguang Auto HarnessLtd.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.