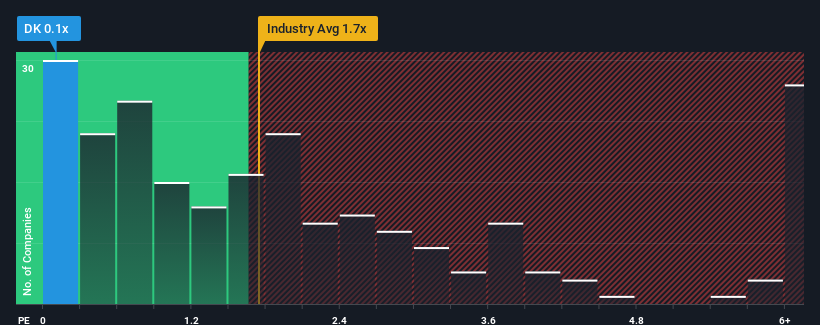

When close to half the companies operating in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") above 1.7x, you may consider Delek US Holdings, Inc. (NYSE:DK) as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Delek US Holdings Performed Recently?

Recent times have been more advantageous for Delek US Holdings as its revenue hasn't fallen as much as the rest of the industry. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Delek US Holdings.Is There Any Revenue Growth Forecasted For Delek US Holdings?

Delek US Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.1%. Even so, admirably revenue has lifted 125% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 15% per annum as estimated by the eleven analysts watching the company. With the industry predicted to deliver 2.8% growth each year, that's a disappointing outcome.

In light of this, it's understandable that Delek US Holdings' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Delek US Holdings' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Delek US Holdings' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Delek US Holdings (of which 2 can't be ignored!) you should know about.

If you're unsure about the strength of Delek US Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.