The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Dasheng Times Cultural Investment Co., Ltd. (SHSE:600892) shareholders for doubting their decision to hold, with the stock down 36% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 22%. More recently, the share price has dropped a further 33% in a month.

After losing 21% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

While Dasheng Times Cultural Investment made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last five years Dasheng Times Cultural Investment saw its revenue shrink by 2.0% per year. That's not what investors generally want to see. The share price decline at a rate of 6% per year is disappointing. But it doesn't surprise given the falling revenue. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

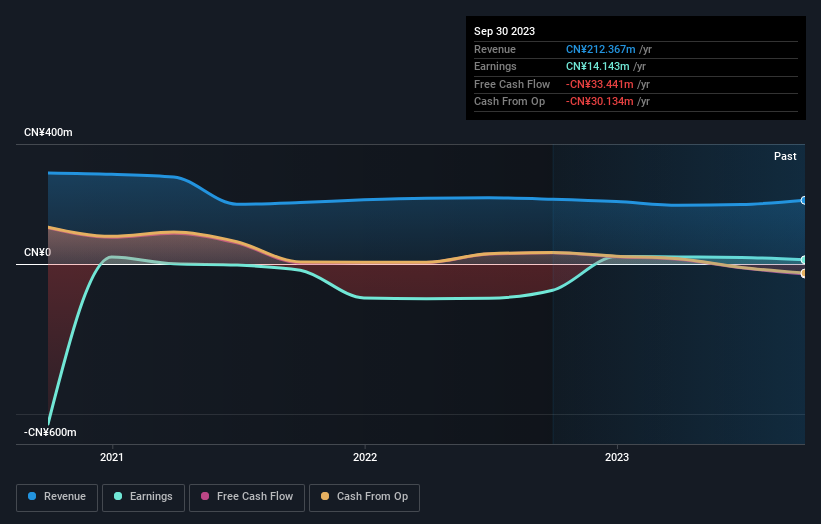

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Although it hurts that Dasheng Times Cultural Investment returned a loss of 22% in the last twelve months, the broader market was actually worse, returning a loss of 26%. Given the total loss of 6% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Dasheng Times Cultural Investment you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.