Investing in stocks inevitably means buying into some companies that perform poorly. Long term Hengli Petrochemical Co.,Ltd. (SHSE:600346) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 68% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 27% lower in that time. Furthermore, it's down 14% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 7.0% decline in the broader market, throughout the period.

Since Hengli PetrochemicalLtd has shed CN¥4.6b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Hengli PetrochemicalLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

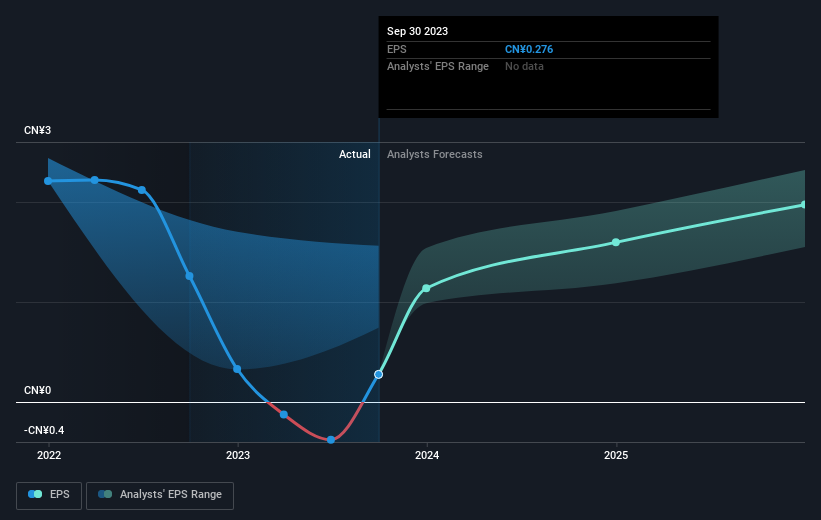

During the three years that the share price fell, Hengli PetrochemicalLtd's earnings per share (EPS) dropped by 47% each year. In comparison the 31% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Hengli PetrochemicalLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Hengli PetrochemicalLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Hengli PetrochemicalLtd shareholders, and that cash payout explains why its total shareholder loss of 65%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Hengli PetrochemicalLtd shareholders are down 27% for the year. Unfortunately, that's worse than the broader market decline of 15%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Hengli PetrochemicalLtd (including 1 which is a bit concerning) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.