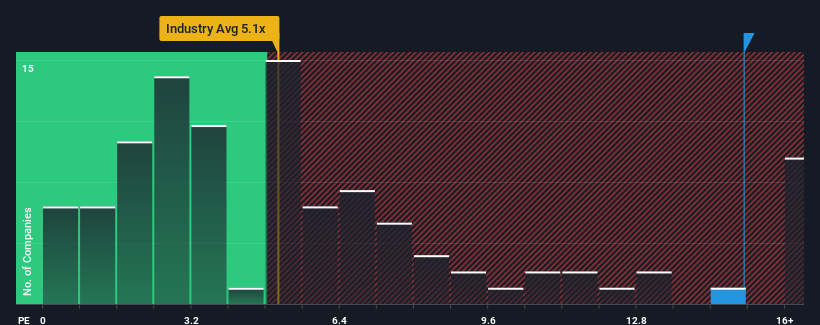

You may think that with a price-to-sales (or "P/S") ratio of 15.1x Advanced Fiber Resources (Zhuhai), Ltd. (SZSE:300620) is a stock to avoid completely, seeing as almost half of all the Communications companies in China have P/S ratios under 5.1x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Advanced Fiber Resources (Zhuhai)

How Advanced Fiber Resources (Zhuhai) Has Been Performing

Advanced Fiber Resources (Zhuhai)'s negative revenue growth of late has neither been better nor worse than most other companies. It might be that many expect the company's revenue to strengthen positively despite the tough industry conditions, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Advanced Fiber Resources (Zhuhai) will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Advanced Fiber Resources (Zhuhai)?

The only time you'd be truly comfortable seeing a P/S as steep as Advanced Fiber Resources (Zhuhai)'s is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 47% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 33% as estimated by the four analysts watching the company. With the industry predicted to deliver 42% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Advanced Fiber Resources (Zhuhai)'s P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Advanced Fiber Resources (Zhuhai) currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 3 warning signs for Advanced Fiber Resources (Zhuhai) (2 can't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on Advanced Fiber Resources (Zhuhai), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.