It's nice to see the Shenzhen Hongtao Group Co.,Ltd. (SZSE:002325) share price up 19% in a week. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 43% in that half decade.

The recent uptick of 19% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Shenzhen Hongtao GroupLtd

Because Shenzhen Hongtao GroupLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Shenzhen Hongtao GroupLtd reduced its trailing twelve month revenue by 25% for each year. That puts it in an unattractive cohort, to put it mildly. On the face of it we'd posit the share price fall of 7% compound, over five years is well justified by the fundamental deterioration. This loss means the stock shareholders are probably pretty annoyed. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

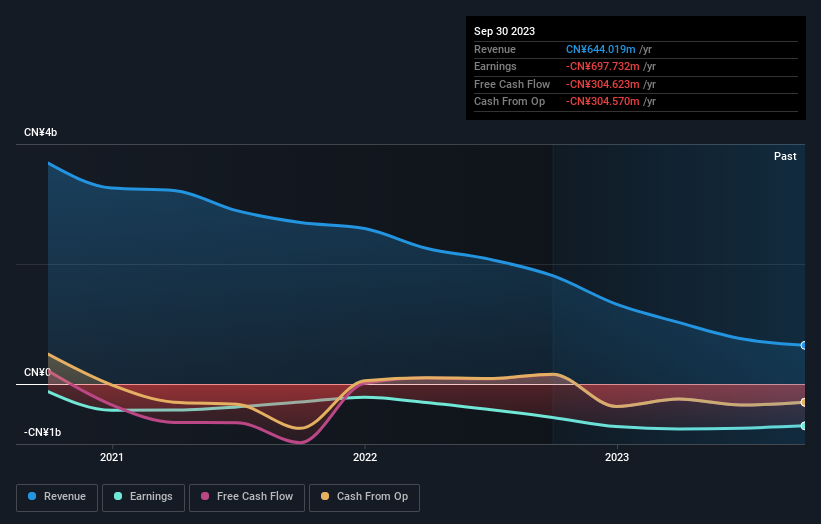

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Shenzhen Hongtao GroupLtd's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 7.7% in the twelve months, Shenzhen Hongtao GroupLtd shareholders did even worse, losing 9.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Shenzhen Hongtao GroupLtd that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.