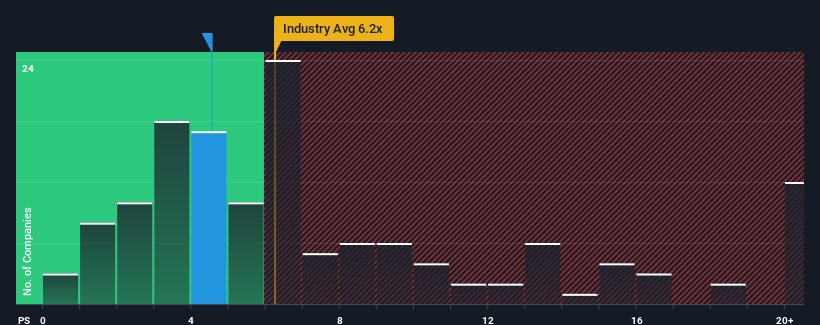

You may think that with a price-to-sales (or "P/S") ratio of 4.5x Business-intelligence of Oriental Nations Corporation Ltd. (SZSE:300166) is a stock worth checking out, seeing as almost half of all the Software companies in China have P/S ratios greater than 6.2x and even P/S higher than 11x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Business-intelligence of Oriental Nations

How Business-intelligence of Oriental Nations Has Been Performing

Business-intelligence of Oriental Nations could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Business-intelligence of Oriental Nations' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Business-intelligence of Oriental Nations would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.6%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.1% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 20% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 36%, which is noticeably more attractive.

With this information, we can see why Business-intelligence of Oriental Nations is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Business-intelligence of Oriental Nations' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Business-intelligence of Oriental Nations maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Business-intelligence of Oriental Nations that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.