David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Fuchun Technology Co., Ltd. (SZSE:300299) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Fuchun Technology

What Is Fuchun Technology's Debt?

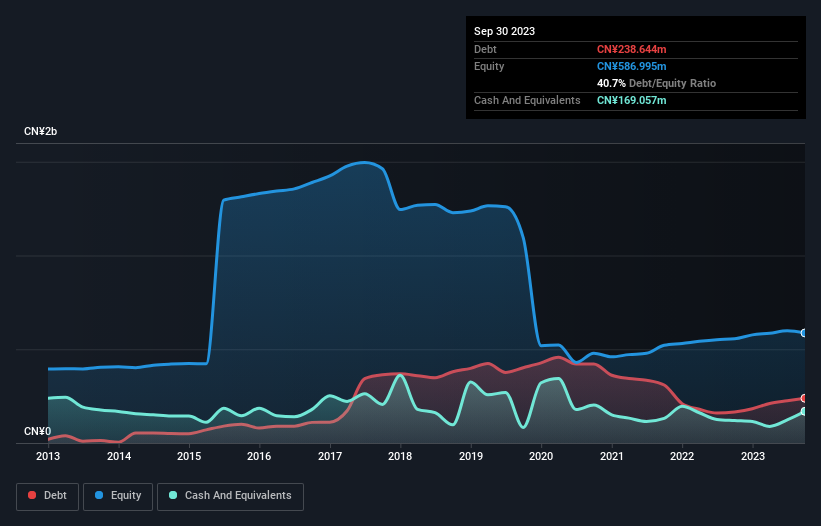

As you can see below, at the end of September 2023, Fuchun Technology had CN¥238.6m of debt, up from CN¥165.2m a year ago. Click the image for more detail. However, it does have CN¥169.1m in cash offsetting this, leading to net debt of about CN¥69.6m.

How Healthy Is Fuchun Technology's Balance Sheet?

According to the last reported balance sheet, Fuchun Technology had liabilities of CN¥425.2m due within 12 months, and liabilities of CN¥59.7m due beyond 12 months. Offsetting this, it had CN¥169.1m in cash and CN¥220.3m in receivables that were due within 12 months. So it has liabilities totalling CN¥95.6m more than its cash and near-term receivables, combined.

Given Fuchun Technology has a market capitalization of CN¥4.07b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Fuchun Technology's net debt is sitting at a very reasonable 2.0 times its EBITDA, while its EBIT covered its interest expense just 2.6 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Importantly, Fuchun Technology's EBIT fell a jaw-dropping 72% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But it is Fuchun Technology's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Fuchun Technology produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Fuchun Technology's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its conversion of EBIT to free cash flow. When we consider all the factors mentioned above, we do feel a bit cautious about Fuchun Technology's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Fuchun Technology (1 is a bit unpleasant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.