Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Zhongmin Energy Co., Ltd. (SHSE:600163) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Zhongmin Energy

What Is Zhongmin Energy's Debt?

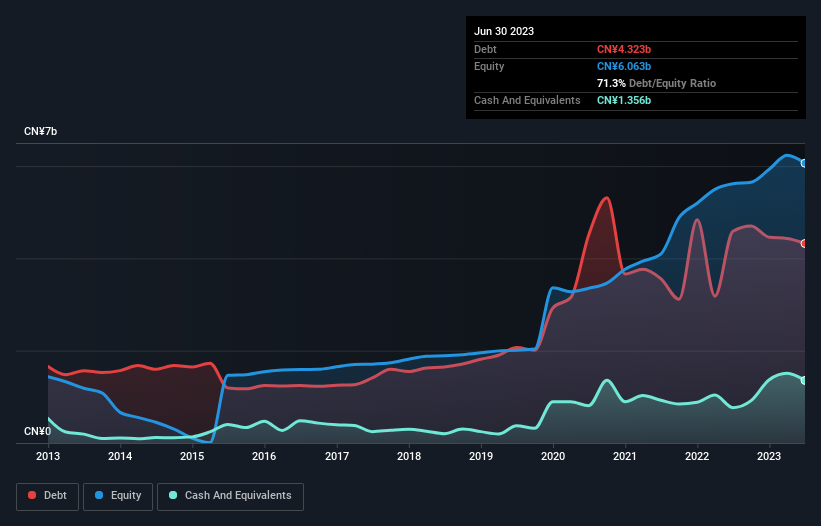

As you can see below, Zhongmin Energy had CN¥4.32b of debt at June 2023, down from CN¥4.59b a year prior. However, it does have CN¥1.36b in cash offsetting this, leading to net debt of about CN¥2.97b.

How Healthy Is Zhongmin Energy's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Zhongmin Energy had liabilities of CN¥1.48b due within 12 months and liabilities of CN¥4.11b due beyond that. On the other hand, it had cash of CN¥1.36b and CN¥2.30b worth of receivables due within a year. So it has liabilities totalling CN¥1.94b more than its cash and near-term receivables, combined.

Zhongmin Energy has a market capitalization of CN¥8.47b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a debt to EBITDA ratio of 2.1, Zhongmin Energy uses debt artfully but responsibly. And the fact that its trailing twelve months of EBIT was 7.9 times its interest expenses harmonizes with that theme. Unfortunately, Zhongmin Energy's EBIT flopped 13% over the last four quarters. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Zhongmin Energy can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Zhongmin Energy recorded free cash flow worth 65% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Based on what we've seen Zhongmin Energy is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. There's no doubt that it has an adequate capacity to convert EBIT to free cash flow. When we consider all the factors mentioned above, we do feel a bit cautious about Zhongmin Energy's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Zhongmin Energy has 2 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.