Sichuan Hezong Medicine Easy-to-buy Pharmaceutical Co., Ltd. (SZSE:300937) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 34%.

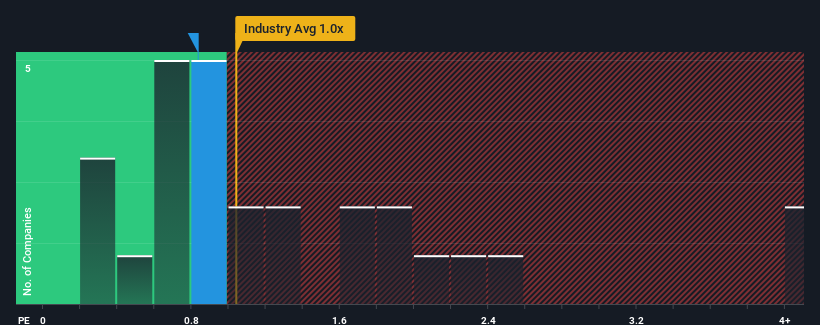

Even after such a large jump in price, there still wouldn't be many who think Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in China's Consumer Retailing industry is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Sichuan Hezong Medicine Easy-to-buy Pharmaceutical

What Does Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's P/S Mean For Shareholders?

Revenue has risen firmly for Sichuan Hezong Medicine Easy-to-buy Pharmaceutical recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The latest three year period has also seen an excellent 64% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 14% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Sichuan Hezong Medicine Easy-to-buy Pharmaceutical is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Sichuan Hezong Medicine Easy-to-buy Pharmaceutical's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sichuan Hezong Medicine Easy-to-buy Pharmaceutical currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Sichuan Hezong Medicine Easy-to-buy Pharmaceutical (of which 1 is significant!) you should know about.

If these risks are making you reconsider your opinion on Sichuan Hezong Medicine Easy-to-buy Pharmaceutical, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.