Whales with a lot of money to spend have taken a noticeably bullish stance on Fair Isaac.

Looking at options history for Fair Isaac (NYSE:FICO) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 12% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $615,625 and 3, calls, for a total amount of $119,300.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1000.0 to $1320.0 for Fair Isaac over the recent three months.

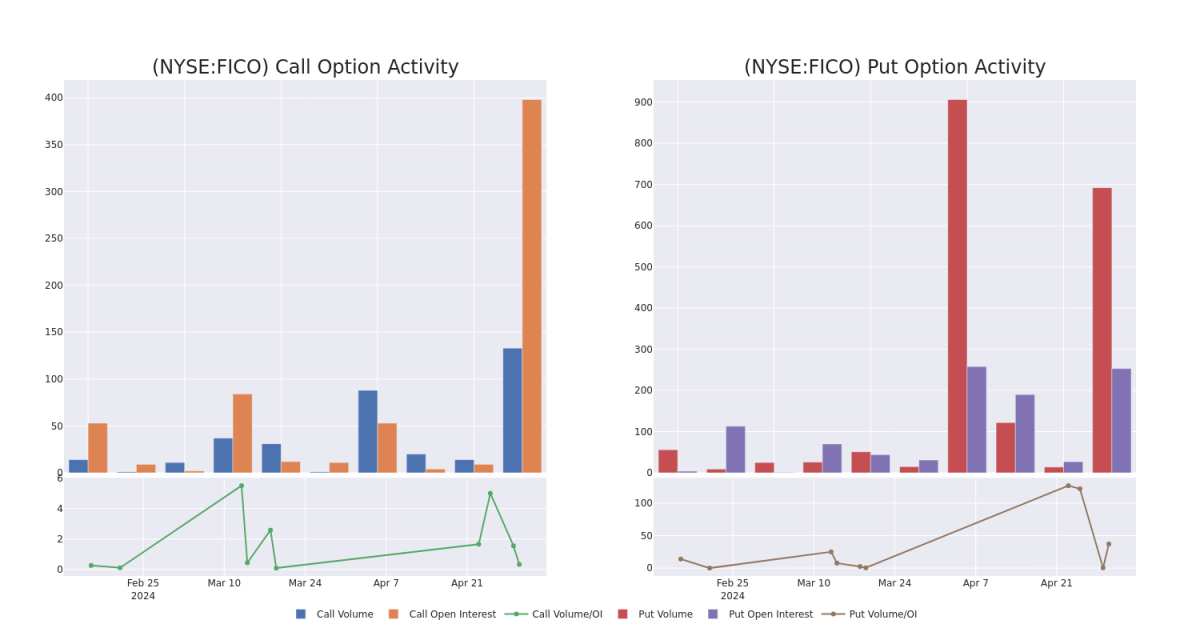

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Fair Isaac stands at 27.33, with a total volume reaching 72.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Fair Isaac, situated within the strike price corridor from $1000.0 to $1320.0, throughout the last 30 days.

Fair Isaac Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FICO | PUT | SWEEP | BULLISH | 12/20/24 | $54.9 | $53.3 | $53.3 | $1150.00 | $298.4K | 88 | 56 |

| FICO | PUT | TRADE | NEUTRAL | 10/18/24 | $95.4 | $88.0 | $92.4 | $1320.00 | $120.1K | 0 | 0 |

| FICO | PUT | TRADE | BULLISH | 10/18/24 | $80.9 | $75.8 | $76.9 | $1290.00 | $92.2K | 2 | 0 |

| FICO | PUT | SWEEP | BULLISH | 10/18/24 | $48.3 | $43.3 | $48.2 | $1200.00 | $57.8K | 56 | 12 |

| FICO | CALL | SWEEP | BEARISH | 06/21/24 | $108.8 | $104.6 | $104.6 | $1280.00 | $52.3K | 13 | 1 |

About Fair Isaac

Founded in 1956, Fair Isaac Corporation is a leading applied analytics company. Fair Isaac is primarily known for its FICO credit scores, which is a widely used industry benchmark to determine the creditworthiness of an individual consumer. The firm's credit scores business accounts for most of the firm's profits and consists of business-to-business and business-to-consumer services. In addition to scores, Fair Isaac also sells software primarily to financial institutions for areas such as analytics, decision-making, customer workflows, and fraud.

In light of the recent options history for Fair Isaac, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Fair Isaac's Current Market Status

- Currently trading with a volume of 205,451, the FICO's price is up by 5.18%, now at $1353.46.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 82 days.

What Analysts Are Saying About Fair Isaac

In the last month, 4 experts released ratings on this stock with an average target price of $1382.75.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $1500.

- Reflecting concerns, an analyst from Redburn Atlantic lowers its rating to Neutral with a new price target of $1113.

- In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $1500.

- An analyst from Raymond James persists with their Outperform rating on Fair Isaac, maintaining a target price of $1418.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Fair Isaac options trades with real-time alerts from Benzinga Pro.