The recent earnings posted by Meihua International Medical Technologies Co., Ltd. (NASDAQ:MHUA) were solid, but the stock didn't move as much as we expected. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Meihua International Medical Technologies issued 6.3% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Meihua International Medical Technologies' historical EPS growth by clicking on this link.

How Is Dilution Impacting Meihua International Medical Technologies' Earnings Per Share (EPS)?

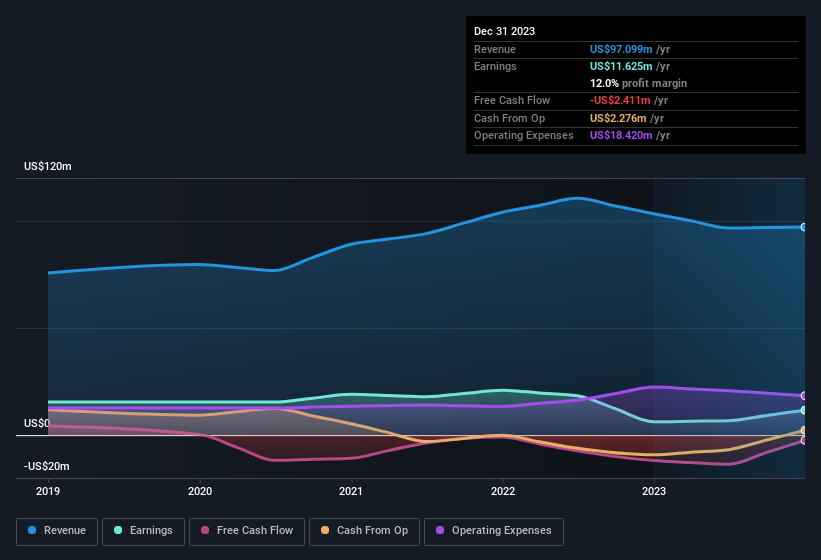

Unfortunately, Meihua International Medical Technologies' profit is down 39% per year over three years. On the bright side, in the last twelve months it grew profit by 86%. But EPS was less impressive, up only 82% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Meihua International Medical Technologies can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Meihua International Medical Technologies.

Our Take On Meihua International Medical Technologies' Profit Performance

Each Meihua International Medical Technologies share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that Meihua International Medical Technologies' statutory profits are better than its underlying earnings power. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. When we did our research, we found 4 warning signs for Meihua International Medical Technologies (1 is potentially serious!) that we believe deserve your full attention.

This note has only looked at a single factor that sheds light on the nature of Meihua International Medical Technologies' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.