To the annoyance of some shareholders, Anhui Hyea Aromas Co., Ltd. (SZSE:300886) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

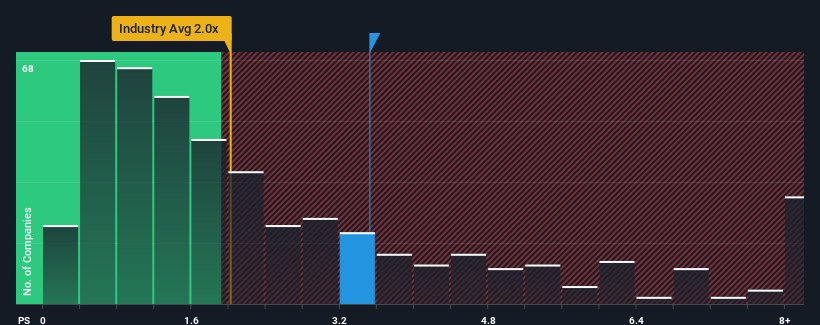

In spite of the heavy fall in price, you could still be forgiven for thinking Anhui Hyea Aromas is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Anhui Hyea Aromas Has Been Performing

Revenue has risen at a steady rate over the last year for Anhui Hyea Aromas, which is generally not a bad outcome. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Anhui Hyea Aromas will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Anhui Hyea Aromas' to be considered reasonable.

Retrospectively, the last year delivered a decent 4.8% gain to the company's revenues. The latest three year period has also seen a 23% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 20% shows it's noticeably less attractive.

With this information, we find it concerning that Anhui Hyea Aromas is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Anhui Hyea Aromas' P/S

There's still some elevation in Anhui Hyea Aromas' P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Anhui Hyea Aromas currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Anhui Hyea Aromas is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.