It hasn't been the best quarter for Adtalem Global Education Inc. (NYSE:ATGE) shareholders, since the share price has fallen 20% in that time. But at least the stock is up over the last year. However, its return of 18% does fall short of the market return of, 26%.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

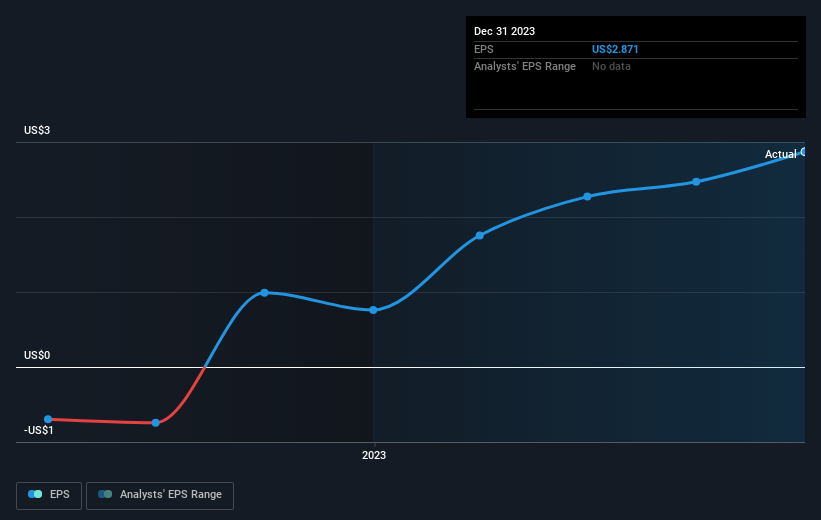

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Adtalem Global Education grew its earnings per share (EPS) by 277%. This EPS growth is significantly higher than the 18% increase in the share price. Therefore, it seems the market isn't as excited about Adtalem Global Education as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Adtalem Global Education has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

Adtalem Global Education shareholders gained a total return of 18% during the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 0.3% per year, over five years. So this might be a sign the business has turned its fortunes around. Before spending more time on Adtalem Global Education it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.