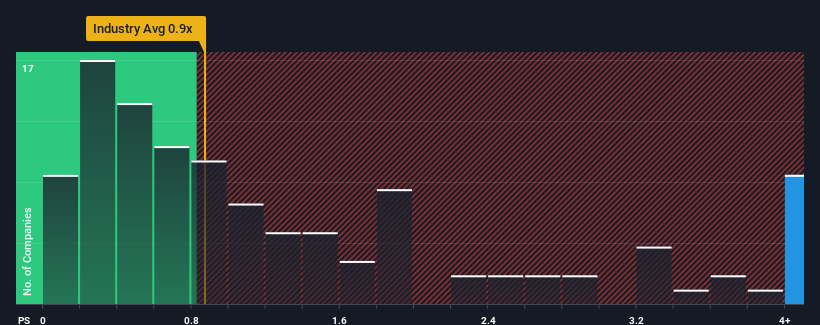

When close to half the companies in the Hospitality industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.9x, you may consider Galaxy Entertainment Group Limited (HKG:27) as a stock to avoid entirely with its 9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Galaxy Entertainment Group Has Been Performing

With revenue growth that's superior to most other companies of late, Galaxy Entertainment Group has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Galaxy Entertainment Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Galaxy Entertainment Group's Revenue Growth Trending?

Galaxy Entertainment Group's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. Still, revenue has fallen 35% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 42% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 26% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Galaxy Entertainment Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Galaxy Entertainment Group's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Galaxy Entertainment Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Hospitality industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about this 1 warning sign we've spotted with Galaxy Entertainment Group.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.