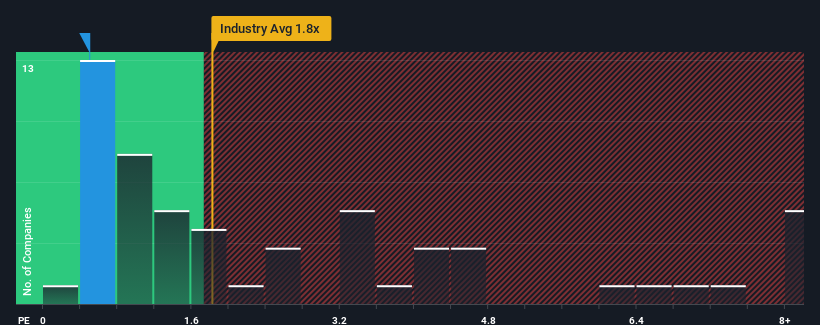

With a price-to-sales (or "P/S") ratio of 0.5x Shanghai Electric Power Co., Ltd. (SHSE:600021) may be sending bullish signals at the moment, given that almost half of all the Renewable Energy companies in China have P/S ratios greater than 1.8x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Shanghai Electric Power

What Does Shanghai Electric Power's P/S Mean For Shareholders?

Recent times haven't been great for Shanghai Electric Power as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Shanghai Electric Power's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Shanghai Electric Power would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The latest three year period has also seen an excellent 77% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company are not great, suggesting revenue should decline by 3.2% over the next year. Meanwhile, the industry is forecast to moderate by 21%, which indicates the company should perform better regardless.

With this information, it's perhaps strange but not a major surprise that Shanghai Electric Power is trading at a lower P/S in comparison. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares excessively.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shanghai Electric Power currently trades on a much lower than expected P/S since its revenue forecast is not as bad as the struggling industry. When we see this a revenue outlook that is advantageous when compared to competitors, we assume potential risks are what might be placing significant pressure on the P/S ratio. Perhaps there is some hesitation about the company's ability to keep resisting the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally constitute a higher P/S and thus share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Shanghai Electric Power that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.