Bio-Techne Corporation (NASDAQ:TECH) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.4% over the last year.

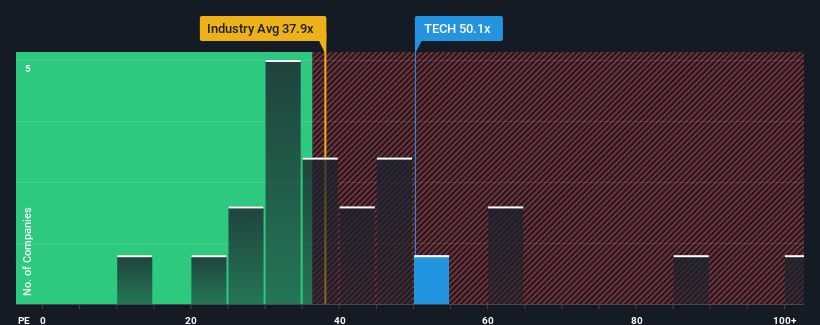

After such a large jump in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Bio-Techne as a stock to avoid entirely with its 50.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings that are retreating more than the market's of late, Bio-Techne has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Bio-Techne

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Bio-Techne's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. As a result, earnings from three years ago have also fallen 3.6% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 5.7% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 13% per year growth forecast for the broader market.

In light of this, it's alarming that Bio-Techne's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

The strong share price surge has got Bio-Techne's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Bio-Techne currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Bio-Techne with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.