Chengdu Olymvax Biopharmaceuticals Inc. (SHSE:688319) shares have had a horrible month, losing 28% after a relatively good period beforehand. The last month has meant the stock is now only up 7.2% during the last year.

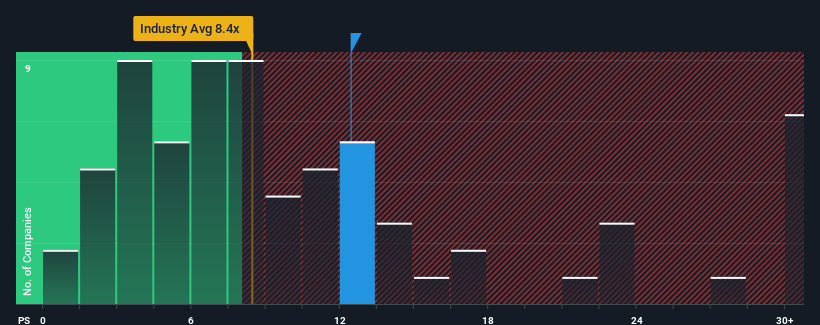

Although its price has dipped substantially, you could still be forgiven for thinking Chengdu Olymvax Biopharmaceuticals is a stock not worth researching with a price-to-sales ratios (or "P/S") of 12.4x, considering almost half the companies in China's Biotechs industry have P/S ratios below 8.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Chengdu Olymvax Biopharmaceuticals

What Does Chengdu Olymvax Biopharmaceuticals' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Chengdu Olymvax Biopharmaceuticals' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Chengdu Olymvax Biopharmaceuticals will help you uncover what's on the horizon.How Is Chengdu Olymvax Biopharmaceuticals' Revenue Growth Trending?

Chengdu Olymvax Biopharmaceuticals' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.7%. Even so, admirably revenue has lifted 65% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 56% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 908%, which is noticeably more attractive.

With this information, we find it concerning that Chengdu Olymvax Biopharmaceuticals is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Chengdu Olymvax Biopharmaceuticals' P/S

Chengdu Olymvax Biopharmaceuticals' P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Chengdu Olymvax Biopharmaceuticals trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 3 warning signs for Chengdu Olymvax Biopharmaceuticals that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.