Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Montauk Renewables (NASDAQ:MNTK) and its ROCE trend, we weren't exactly thrilled.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Montauk Renewables:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

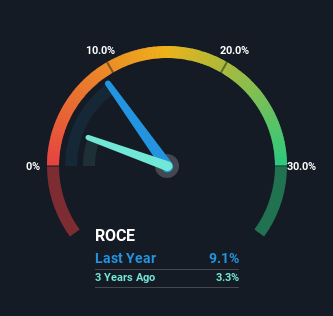

0.091 = US$27m ÷ (US$336m - US$35m) (Based on the trailing twelve months to June 2023).

So, Montauk Renewables has an ROCE of 9.1%. In absolute terms, that's a low return, but it's much better than the Renewable Energy industry average of 2.7%.

See our latest analysis for Montauk Renewables

In the above chart we have measured Montauk Renewables' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Montauk Renewables here for free.

What The Trend Of ROCE Can Tell Us

In terms of Montauk Renewables' historical ROCE trend, it doesn't exactly demand attention. Over the past four years, ROCE has remained relatively flat at around 9.1% and the business has deployed 34% more capital into its operations. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

The Bottom Line

Long story short, while Montauk Renewables has been reinvesting its capital, the returns that it's generating haven't increased. And investors appear hesitant that the trends will pick up because the stock has fallen 30% in the last year. Therefore based on the analysis done in this article, we don't think Montauk Renewables has the makings of a multi-bagger.

On a final note, we've found 2 warning signs for Montauk Renewables that we think you should be aware of.

While Montauk Renewables isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.