私は最終的に誇りに思って1株21ドルで金持ち株を持っていますか?

私はもう長い間富の道で売っています。今回のように、やっと手に入れたかもしれません![]()

![]()

![]()

もし来週の三十時にそれを買うことができれば、私のコスト基礎は一株二十一ポンドです。は、販売権は904ポンドの割増を得たからです![]()

この熊市でもっと多くの取引を探す時だが、核戦争を恐れてもそうだ。うん,うん

五月十日

もし来週の三十時にそれを買うことができれば、私のコスト基礎は一株二十一ポンドです。は、販売権は904ポンドの割増を得たからです

この熊市でもっと多くの取引を探す時だが、核戦争を恐れてもそうだ。うん,うん

五月十日

五月十三日

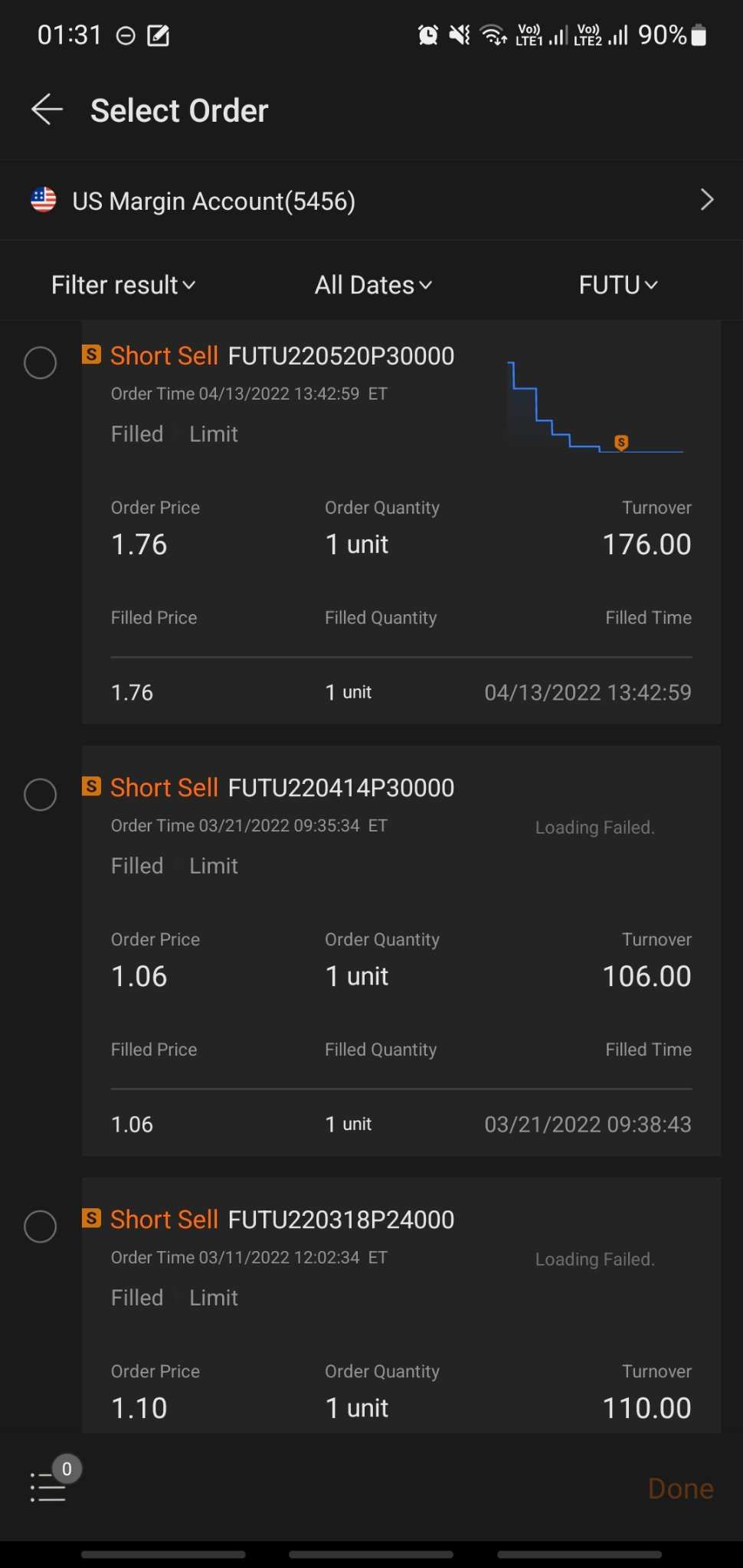

注文書

免責事項:このコミュニティは、Moomoo Technologies Inc.が教育目的でのみ提供するものです。

さらに詳しい情報

コメント

サインインコメントをする

toomanyscammers : pls teach me haha. I'm the buyer who bought futu at 30 long. hahajHha

doctorpot1スレ主 toomanyscammers: oh it is simple but a bit more complex an risky la, but it is known as a cash secured PUT option strategy.

So I sell PUT option at the price I willing to buy FUTU at, regardless of what the current price is. e.g. price was 37 but I only will to pay 30 so sell PUT at 30. this means I can be forced to buy FUTU at 30 a share, but I get to collect fees for selling the option and each PUT option contract is for 100 shares. So I have 3000 standby to buy futu if I ever get forced to buy it. why will people force me to buy futu at 30? usually cause the price crash below 30, so this way they earn money. e.g. price now 28, they buy 100 share and force me to buy at 30 a share so earning $200 liao.

so I have been selling the options for many months already and collected $900 in fees, but never once was forced to buy. but now the market crash so quite likely I might be forced to buy the shares at 30 hahahha. but accounting for the fees collected over the months, it is like buying at 21 a share hahahha.

but option got risk de ah, cannot anyhow anyhow do.

Conn_00 doctorpot1スレ主: Hi, I'm newbie here. I would like to learn too. May I asked :

1) What if u sell option for FUTU @ 30 with the current price @ 37 (example), by the time the price didn't reach 30, what will happen?

2) Any charges fees occurred when u sell option?

3) Is it need to put the date during sell option? If yes, how long should we put the date?

4) When the price reach 30 & u hv to execute the option by forced to buy 100 shares @ 30 (as per ur desired price), is it the sell option action will execute automatically or we need to press/select it in moomoo? Is it need to pay additional fees when the the price reach 30 & force to buy 100 shares?

5) How to do the "sell option" in moomoo?

Thank you

doctorpot1スレ主 Conn_00: If you are new here are links to learn more, before trying out options, you should understand it fully before using it because options are leveraged products and are more complex, so if used wrongly it can cause you to lose a lot of money. Here are some links for you to start learning about options:

https://youtu.be/VJgHkAqohbU

https://youtu.be/8YVuvI9VLqw

https://youtu.be/l9ta2nLXoao

https://live.moomoo.com/course/1302?source=share&nn_page_type=course_catalog&source=share&lang=en-us&data_ticket=5b3500b278c1b7aa4a176e85285988a1

Some "safer" strategies

WHEEL: https://youtu.be/M6MqKI2uMIE

LEAPS: https://youtu.be/95suqaJcFtU

doctorpot1スレ主 Conn_00: In regards to your question

1) if the price didnt drop below 30. Most likely nothing will happen. You keep the premium and nothing happens. Why? Because if the current price is 31 then the person can sell to the market at 31 instead of selling to you at 30.

2) yes, there is a fee when you buy or sell but no fee when it is exercised. Link is here: https://support.futusg.com/topic143/h5

3) yes every option contract will have an expiry date. For the date that depends on what strategies you are using, the IV% and your outlook on the price movement. For Cash Secure PUT, I will go for monthly because that have the highest time decay (which means the options value drops the fastest)

4) When the price reach 30, the option buyer have the choice of forcing me to buy from him. So if they force you to buy then yea, you will automatically buy them at the strike price. Each contract is 100 shares and there are no fees.

5) you can follow the photo

Conn_00 doctorpot1スレ主: Thank you so much for your sharing

doctorpot1スレ主 Conn_00: 問題ありません オプションを学ぶことで、ヘッジのような厳しい時期を乗り切るのに役立つ多くの戦略が開かれるので素晴らしいです。安全に取引してください!

オプションを学ぶことで、ヘッジのような厳しい時期を乗り切るのに役立つ多くの戦略が開かれるので素晴らしいです。安全に取引してください!

High Profit Low Loss doctorpot1スレ主: You are selling put, so you collected 3 contracts of premium.

doctorpot1スレ主 High Profit Low Loss: ええ、売って保険料を集めました。しかし、売る契約の数に応じて、それに応じていくら徴収します。プレミアムはオプション価格* 100になります

High Profit Low Loss : 現金担保付きPUTとは、行使価格の100株分の現金が必要だということですよね?

もっとコメントを見る...