最新

人気

最新のFRB会議について知っておくべきことは次のとおりです。

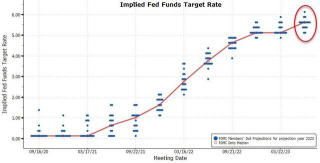

-今のところ、金利の引き上げは一時停止しています

-金利は今年の残りの期間、高い水準にとどまる可能性があります

-とはいえ、ピーク金利にはかなり近づいています

ザは $SPDR S&P 500 ETF(SPY.US$ 10月の安値から20%以上上昇した後、強気相場に突入しました。

次に私たちが注目していることについてもっと読んでください:FRBは利上げを一時停止します。国債や株にとっての意味は次のとおりです

-今のところ、金利の引き上げは一時停止しています

-金利は今年の残りの期間、高い水準にとどまる可能性があります

-とはいえ、ピーク金利にはかなり近づいています

ザは $SPDR S&P 500 ETF(SPY.US$ 10月の安値から20%以上上昇した後、強気相場に突入しました。

次に私たちが注目していることについてもっと読んでください:FRBは利上げを一時停止します。国債や株にとっての意味は次のとおりです

翻訳済み

2

新着情報

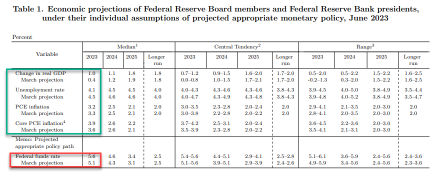

2023年6月のFOMC会合において、連邦準備制度理事会(FED)は連邦基金金利を引き上げず、5.00%〜5.25%の水準を維持し、政策金利を今後2回引き上げる方針を表明。これは、16年ぶりの最高水準を維持することになります。この決定は、昨年7月以来、前の7回の会合と同様に、FOMC投票委員全員の支持を得ました。

今回のFEDの利上げサイクルでの最初の休止ですが、本年後半に2回の利上げがある可能性が示唆されています。2022年3月から現在まで中央銀行による連続10回の利上げを開始したところであります。

2023年6月のFOMC会合において、連邦準備制度理事会(FED)は連邦基金金利を引き上げず、5.00%〜5.25%の水準を維持し、政策金利を今後2回引き上げる方針を表明。これは、16年ぶりの最高水準を維持することになります。この決定は、昨年7月以来、前の7回の会合と同様に、FOMC投票委員全員の支持を得ました。

今回のFEDの利上げサイクルでの最初の休止ですが、本年後半に2回の利上げがある可能性が示唆されています。2022年3月から現在まで中央銀行による連続10回の利上げを開始したところであります。

翻訳済み

25

3

米労働局のデータによると、5月のインフレ率が4.9%から4.0%に低下したことから、ドルは3週間ぶりの安値に下落拡大しました。WSJ調査のアナリストの予想通り、コアインフレも5.5%から5.3%に低下しました。Zaye Capital Marketsの最高投資責任者、ナエム・アスラム氏は、「この夏は連邦準備制度理事会が金融政策の引き締めを控える」必要があると述べています。

翻訳済み

30の株価指標は今年わずか2%上昇し、より変動の激しい同業種は急上昇しています。

ダウ・ジョーンズ・インダストリアル平均は金曜日にわずか0.1%の上昇で、薄商いの一週間を締めくくりました。ウォール街のブルーチップ指数は、2つの指数、S&P 500とナスダックに圧倒的に勝たれています。ダウは今年わずか2%上昇し、広範なS&P 500は12%上昇し、テクノロジーに特化したナスダックは27%上昇しました。

なぜそのような違いがあるのでしょうか?

ダウ・ジョーンズ・インダストリアル平均は金曜日にわずか0.1%の上昇で、薄商いの一週間を締めくくりました。ウォール街のブルーチップ指数は、2つの指数、S&P 500とナスダックに圧倒的に勝たれています。ダウは今年わずか2%上昇し、広範なS&P 500は12%上昇し、テクノロジーに特化したナスダックは27%上昇しました。

なぜそのような違いがあるのでしょうか?

翻訳済み

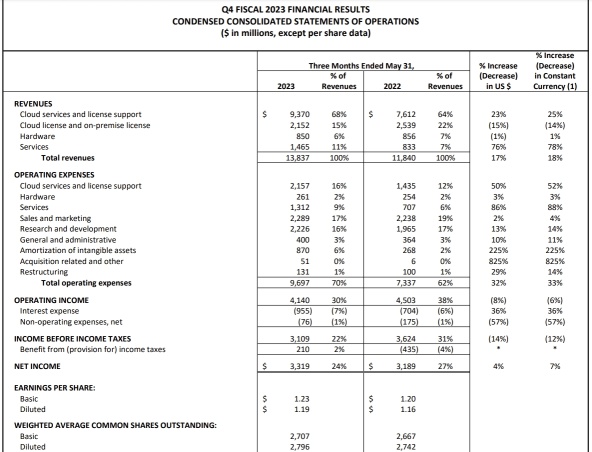

6月12日現在、オラクルは年初来で 44% 上昇しています。同社が予想を上回る最新の財務報告書を発表した後、営業時間外にはさらに 3.64% 上昇しました。では、今回の会社の財務報告の業績はどうですか?また、将来株価が上昇する余地はありますか?

1。オラクルの全体的な業績は予想を上回りましたが、レバレッジ比率は依然として驚くほど高いです

2023年度の同社の総収益は500億米ドル、前年比+ 18%です。23年度には...

1。オラクルの全体的な業績は予想を上回りましたが、レバレッジ比率は依然として驚くほど高いです

2023年度の同社の総収益は500億米ドル、前年比+ 18%です。23年度には...

翻訳済み

8

ほとんどの大手ウォールストリート銀行は、強い雇用市場と高いインフレ率による鷹派的なトーンを維持しながら、水曜日に利上げを維持すると予想しています。

複数の経済学者によると、6月の会合でスキップとハイクのどちらかがある可能性があります。多くの銀行は、中央銀行が7月のハイクに向けて市場を準備すると予想しています。

現在、マネーマーケットでは今月の中断の確率が70%以上で、レートカットの期待は来年まで後退しています...

複数の経済学者によると、6月の会合でスキップとハイクのどちらかがある可能性があります。多くの銀行は、中央銀行が7月のハイクに向けて市場を準備すると予想しています。

現在、マネーマーケットでは今月の中断の確率が70%以上で、レートカットの期待は来年まで後退しています...

翻訳済み

中国の燃料需要の伸びとロシアの原油供給の増加に対する懸念が市場に重くのしかかる中、投資家が中央銀行のさらなる利上げへの意欲を評価しようとしたため、月曜日に石油価格は下落しました。

ブレント原油先物は、グリニッジ標準時6時47分までに70セント、つまり0.94%下落して1バレルあたり74.09ドルになりました。米国西テキサス中級(WTI)原油は69.53ドルで、0.91%下落しました。

どちらのベンチマークも2回連続で週次評価を記録しました...

ブレント原油先物は、グリニッジ標準時6時47分までに70セント、つまり0.94%下落して1バレルあたり74.09ドルになりました。米国西テキサス中級(WTI)原油は69.53ドルで、0.91%下落しました。

どちらのベンチマークも2回連続で週次評価を記録しました...

翻訳済み

カナダの主要な資源を多く含む株価指数の先物は、商品価格の低迷を受けて月曜日に小幅に下落しました。一方、投資家は今週後半に予定されている米国連邦準備制度理事会の金利決定を待っていました。

S&P/TSX指数(SxFC1)の6月の先物は、東部標準時午前7時39分(グリニッジ標準時11時39分)に0.1%下落しました。

エコノミストやトレーダーは、米国中央銀行が市場を圧迫する金利引き上げを1年以上ぶりに中止すると広く予想しています...

S&P/TSX指数(SxFC1)の6月の先物は、東部標準時午前7時39分(グリニッジ標準時11時39分)に0.1%下落しました。

エコノミストやトレーダーは、米国中央銀行が市場を圧迫する金利引き上げを1年以上ぶりに中止すると広く予想しています...

翻訳済み

- 先週の木曜日に公表された6月3日の初期失業保険請求データは、前回および予測値であるそれぞれ232kと235kを上回る261kに急上昇し、2012年10月以来の最高値となった。

- 5月の消費者物価指数(CPI)の予想値は0.2%の月次で、前回の0.4%の月次よりも低く、長期にわたる鷹派の利上げ休止の開始の可能性を高めています。

- 結果、私たちは、巨大保有国債資産の軽減に向けた措置の一部としての政策転換の開始の可能性が高まると考えています。

- 5月の消費者物価指数(CPI)の予想値は0.2%の月次で、前回の0.4%の月次よりも低く、長期にわたる鷹派の利上げ休止の開始の可能性を高めています。

- 結果、私たちは、巨大保有国債資産の軽減に向けた措置の一部としての政策転換の開始の可能性が高まると考えています。

翻訳済み

6

2