最新

人気

インフレ率が上昇し、FRBの利上げと景気見通しが不透明なことから、月曜日にはS&P500、ダウ・ジョーンズ、ナスダック100がそれぞれ0.90%、0.5%、1.5%下落しました。しかし、逆向きのETFであるSQQQは市場の流れに逆らって、最近5日間で16.84%上昇し、逆向きのETFの利点を強調しました。![]()

変動の激しい市場においてリスクを軽減するには、よく分散された投資ポートフォリオを作成し、いくつかの逆向きのETFを配置することが必要です。

変動の激しい市場においてリスクを軽減するには、よく分散された投資ポートフォリオを作成し、いくつかの逆向きのETFを配置することが必要です。

翻訳済み

47

これが一時的な熊市の反発になるかどうかはまだわかりません。

結局、私たちは見ることができます。インフレはまだ進行中であり、利上げは成長と製造業を抑制し始めています。アメリカ経済は、2四半期連続でマイナス成長を経験しました。

翻訳済み

101

19

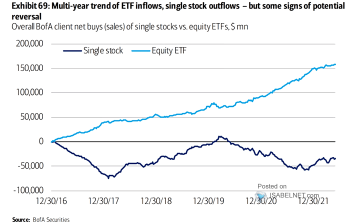

逆ETFの急激な上昇に伴い、市場の弱気感情が強まっています。7月12日までに、米国株式レバレッジされた逆ETFに14億ドルの流入がありました。

多くの投資家が、逆ETFを利用して短期的な利益を拡大したり、リスクをヘッジしたりすることを検討しているかもしれません。![]()

![]()

![]() ここにいくつかの注目すべきインバースETFがあります。投資機会についてはバナーをクリックしてください!

ここにいくつかの注目すべきインバースETFがあります。投資機会についてはバナーをクリックしてください!

$プロシェアーズ・ウルトラプロ・ショートS&P500(SPXU.US$, $プロシェアーズ・ウルトラプロ・ショートQQQ(SQQQ.US$, $プロシェアーズ・ウルトラショートQQQ(QID.US$,���������...

多くの投資家が、逆ETFを利用して短期的な利益を拡大したり、リスクをヘッジしたりすることを検討しているかもしれません。

$プロシェアーズ・ウルトラプロ・ショートS&P500(SPXU.US$, $プロシェアーズ・ウルトラプロ・ショートQQQ(SQQQ.US$, $プロシェアーズ・ウルトラショートQQQ(QID.US$,���������...

翻訳済み

13

投資家として、経済的な出来事による不確実性に対して強靭な資産を持ちたいと考えています。例えば、利上げなどです。

利上げは新しいことではありません。連邦準備制度理事会(FRB)は1年以上にわたり利上げを続けており、市場に不確実性をもたらしています。

しかし、上昇する金利と市場の不確実性にもかかわらず、私たちは長期的な退職戦略に忠実であるべきであり、最近の騒動を無視し、投資を継続する必要があります。

利上げは新しいことではありません。連邦準備制度理事会(FRB)は1年以上にわたり利上げを続けており、市場に不確実性をもたらしています。

しかし、上昇する金利と市場の不確実性にもかかわらず、私たちは長期的な退職戦略に忠実であるべきであり、最近の騒動を無視し、投資を継続する必要があります。

翻訳済み

+1

3

インバース etf への投資 は、市場の下落から利益を得ることができます。株式市場が下落すると、ほとんどの投資家は損失を被ります。しかし、正確に市場方向を予測することができれば、反対のETFに投資することで利益を得ることができます。![]()

![]()

$プロシェアーズ・ウルトラプロ・ショートQQQ(SQQQ.US$

SQQQは、デイリーターゲットを持つインバースetfです。そのためSQQQはデイ中取引されるように設計されており、利益を素早く減らす費用や劣化を引き起こすような長期的な投資には適していません。したがって、長期的な保持には適さず、短期的な、高リスクですが、ナスダック100が下落した場合の高い利益を狙った取引を目的としています。

$プロシェアーズ・ウルトラプロ・ショートQQQ(SQQQ.US$

SQQQは、デイリーターゲットを持つインバースetfです。そのためSQQQはデイ中取引されるように設計されており、利益を素早く減らす費用や劣化を引き起こすような長期的な投資には適していません。したがって、長期的な保持には適さず、短期的な、高リスクですが、ナスダック100が下落した場合の高い利益を狙った取引を目的としています。

翻訳済み

5

3