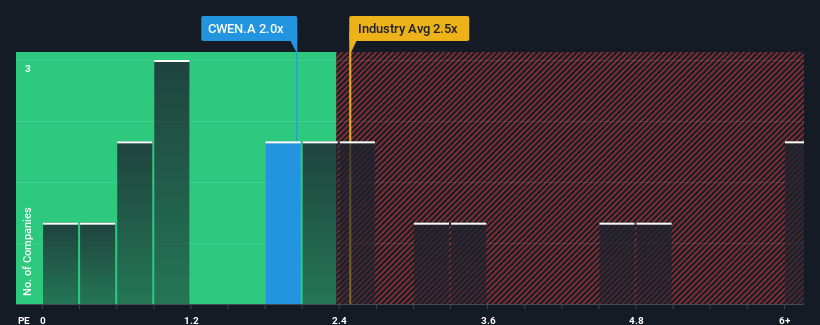

It's not a stretch to say that Clearway Energy, Inc.'s (NYSE:CWEN.A) price-to-sales (or "P/S") ratio of 2x right now seems quite "middle-of-the-road" for companies in the Renewable Energy industry in the United States, where the median P/S ratio is around 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Clearway Energy Has Been Performing

With revenue growth that's superior to most other companies of late, Clearway Energy has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clearway Energy.Is There Some Revenue Growth Forecasted For Clearway Energy?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Clearway Energy's to be considered reasonable.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen a 9.6% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 4.8% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.3% per year, which is not materially different.

With this information, we can see why Clearway Energy is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Clearway Energy maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 4 warning signs for Clearway Energy (1 is potentially serious!) that we have uncovered.

If you're unsure about the strength of Clearway Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.