Ninebot Limited (SHSE:689009) shares have continued their recent momentum with a 27% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 9.7% isn't as impressive.

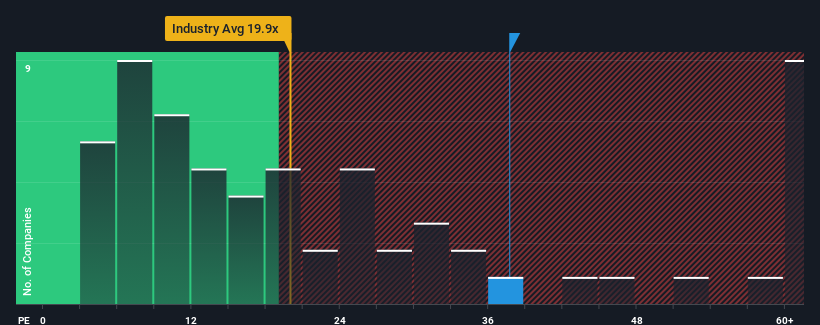

After such a large jump in price, Ninebot's price-to-earnings (or "P/E") ratio of 37.7x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 32x and even P/E's below 19x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Ninebot as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

Ninebot's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 68%. The latest three year period has also seen an excellent 203% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 24% per year during the coming three years according to the seven analysts following the company. With the market predicted to deliver 23% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's curious that Ninebot's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Ninebot's P/E

Ninebot shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ninebot currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Ninebot that you should be aware of.

If you're unsure about the strength of Ninebot's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.