Guangdong Faith Long Crystal Technology Co.,LTD. (SZSE:300460) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

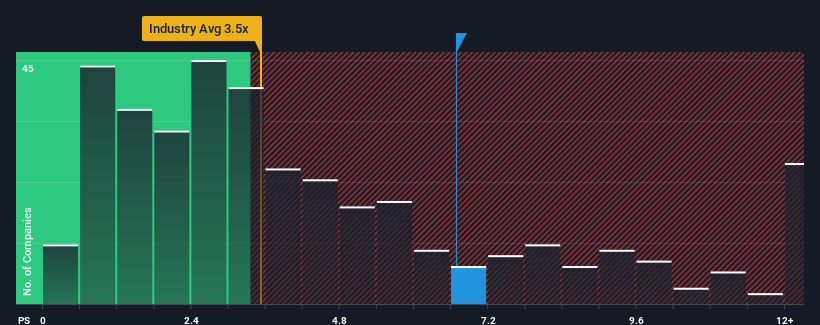

Even after such a large drop in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.5x, you may still consider Guangdong Faith Long Crystal TechnologyLTD as a stock not worth researching with its 6.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Guangdong Faith Long Crystal TechnologyLTD

What Does Guangdong Faith Long Crystal TechnologyLTD's Recent Performance Look Like?

For instance, Guangdong Faith Long Crystal TechnologyLTD's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangdong Faith Long Crystal TechnologyLTD will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Guangdong Faith Long Crystal TechnologyLTD's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 22%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.6% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 60% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Guangdong Faith Long Crystal TechnologyLTD's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Final Word

A significant share price dive has done very little to deflate Guangdong Faith Long Crystal TechnologyLTD's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Guangdong Faith Long Crystal TechnologyLTD currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 4 warning signs for Guangdong Faith Long Crystal TechnologyLTD (3 are potentially serious!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.