暂无数据

代码股票名称

最新价涨跌额涨跌幅成交量成交额今开昨收最高最低总市值流通市值总股本流通股本5日涨跌幅10日涨跌幅20日涨跌幅60日涨跌幅120日涨跌幅250日涨跌幅年初至今涨跌幅股息率TTM换手率市盈率TTM市盈率(静)振幅所属行业

暂无内容

快讯 | 纽约证券交易所订单失衡 66361.0 股卖出方

快讯 | 纽约证券交易所订单失衡 178502.0 股买入方

业内人士买入森普拉和其他两只股票

尽管周五美国股市收高,但仍有一些值得注意的内幕交易。当内部人士购买股票时,这表明他们对公司的前景充满信心或对股票的看法

董事理查德·马克收购森普拉(SRE)的股份

桑普拉能源(SRE.US)董事增持1,925股普通股股份,价值约15.01万美元

5月17日报道,根据美国证券交易委员会(SEC)5月17日披露的文件,$桑普拉能源(SRE.US)$董事MARK RICHARD J于5月17日以每股平均价77.97美元增持1,925股普通股股份,价值约为15.01万美元。图片来源:SEC官网 什么是持股变动声明?SEC要求上市公司内幕人士公开披露其证券交易和持股情况,当内幕人士的持股发生变化时,根据不同情形,需要在交易结束后的一定时间内向SEC

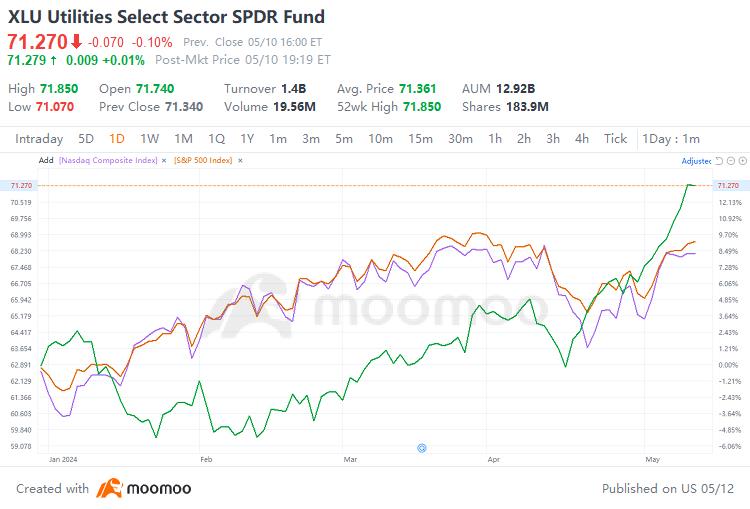

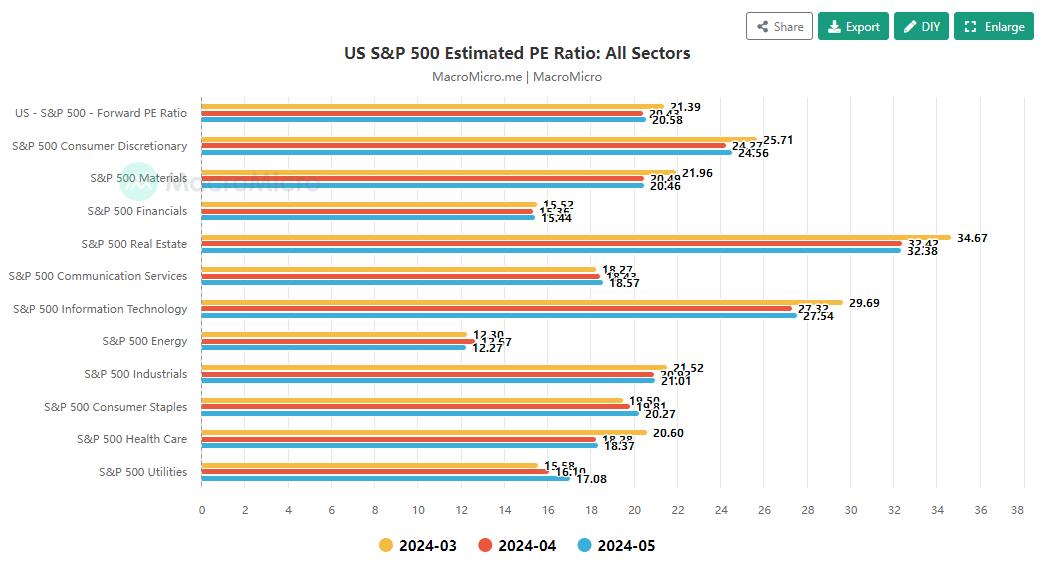

公用事业在过去3个月中飙升,但现在正在发出超买信号

10baggerbamm : all these so-called experts they're late to the game as usual typically they downgrade at a bottom and upgrade at a near top. I was buying utsl pounding the table telling people to buy it at $14 and hit 29 this past Friday. now I'm buying DRN..ETF, 12 months this is going to be north of $20. for the most undervalued individual stock equity in the US marketplace...its KNDI. TRADING AT 1.6 TIMES REVENUE IT'S RIDICULOUS THE COMPANY IS NOW PROFITABLE THE COMPANY BOUGHT BACK 30 MILLION WORTH OF STOCK THE FIRST QUARTER IN THE OPEN MARKET 4TH QUARTER LAST YEAR THE COMPANY COMPLETED ITS US DISTRIBUTION NETWORK THE US MARKET SHARE GREW OVER 50% LAST QUARTER REVENUE GROWTH. the stock's been over $20 in the past when it was nowhere near as well run and able to execute like they are today.. this company should be trading at a minimum 5 to 10 times revenues right now which would put this stock between 10 and 20 and once people realize what it is they just got to deal with the NFL the right to use their marketing and they're building EVS tagged with all the NFL teams it just was announced this past weekend they're growing their executing and rather than Chase yesterday's hero nothing wrong with Microsoft I own it I've owned it 20 years but I'm not going to get tenfold price increase in Microsoft in 2 years or one year and I believe I will in kndi.